“We are on a path to continually shrink the electricity we generate from coal, and that has made electricity more expensive and our grid less stable.” - Department of Energy Secretary Chris Wright on Bloomberg TV.

Secretary Wright is absolutely right. America must stop closing its coal plants because they generate some of the most affordable and reliable electricity in the country, especially compared to wind, solar, and battery storage. On top of that, a single coal plant can also provide billions of dollars in energy storage value, compared to battery storage, for almost no cost.

Today’s piece will dive into the data showing why the coal fleet provides low-cost, reliable, and fuel-secure power and should continue to do so for decades to come.

Affordable Energy: The Cost of Existing Coal Plants

Most of America’s coal plants are like houses where the mortgages have been paid off; these depreciated assets have no loans or interest to repay, so the cost of generating electricity from them consists of things like property taxes, insurance, labor and maintenance, and fuel costs.

As a result, Federal Energy Regulatory Commission (FERC) data show that America’s existing coal plants are some of the most affordable power generators in the nation.

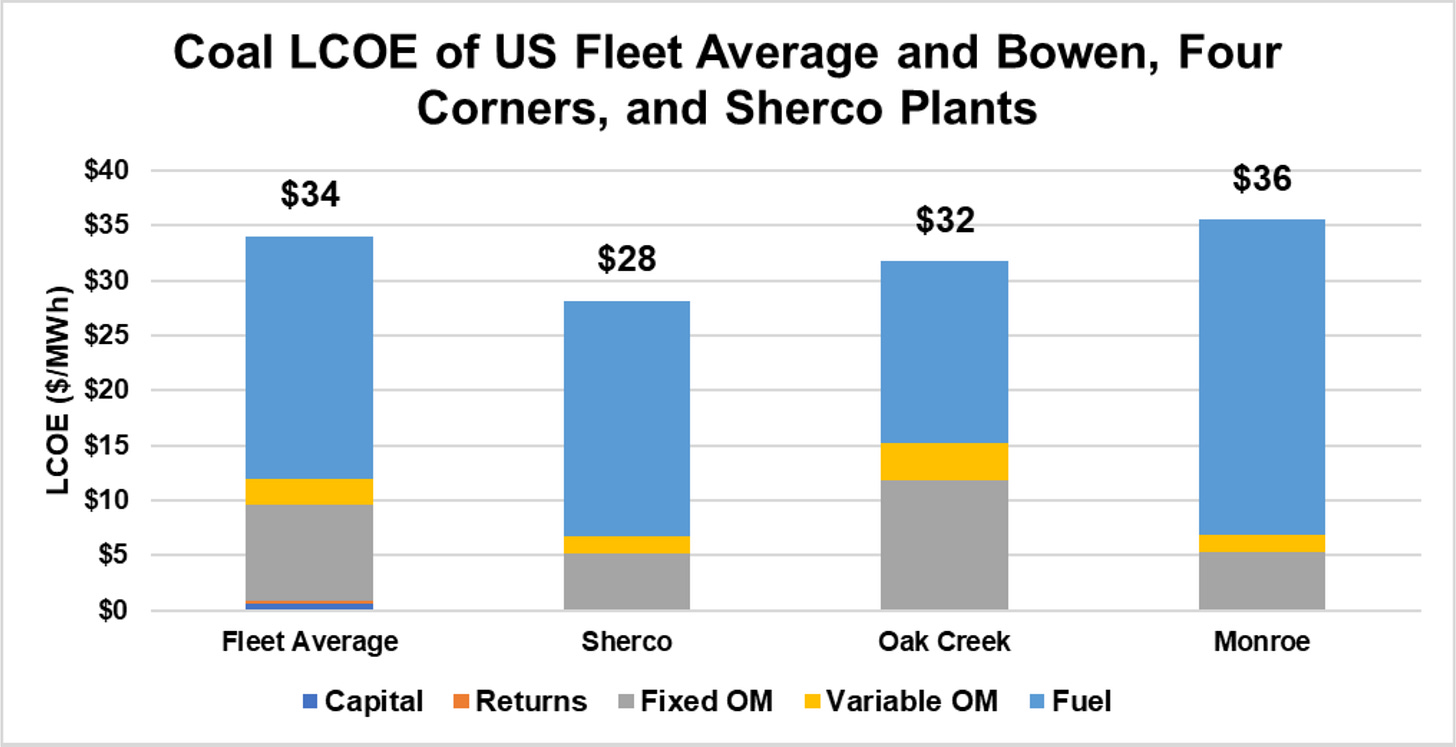

The graph below shows that the average coal plant in the U.S. generated electricity for $34 per megawatt-hour (MWh) according to the latest FERC Form 1 Filings updated in 2020 (FERC ended its practice of compiling all the utility FERC Form data). We included a few select plants from individual FERC Form 1 filings in 2023: the Sherburne County Generating Station (Sherco), owned by Xcel Energy in Minnesota; the South Oak Creek Plant, owned by Wisconsin Electric Power Co., and the Monroe Plant, owned by DTE Electric.

The low costs of the South Oak Creek plant are likely a key reason Wisconsin Electric wisely extended the life of South Oak Creek past its original 2023 retirement date to help with growing demand and is now planning to convert it to natural gas by 2028. We say just keep it as a low-cost, reliable coal plant, but at least it’s capacity that will remain on the system. In a similar fashion, DTE Electric should continue to run Monroe beyond 2032, and Xcel Energy should restart Unit 2 at Sherco and run the plants beyond 2030.

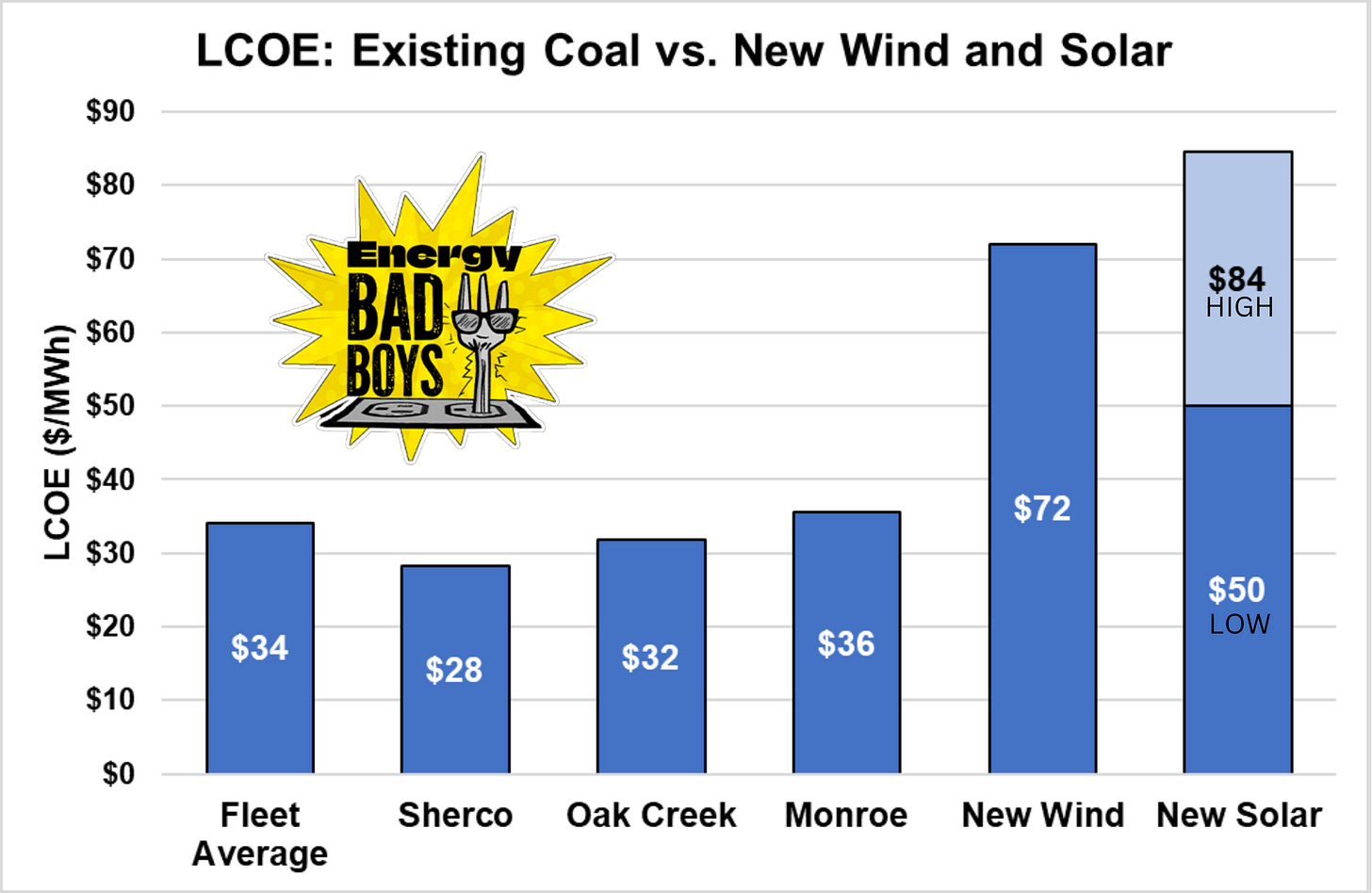

American families and businesses would benefit from running the coal plants longer because they are much more affordable than new wind or solar generators that are theoretically replacing them. In our previous articles, we estimated that new onshore wind costs around $72 per MWh, and new solar can range anywhere from $50 per MWh to $84.50 per MWh.

This means new wind and solar facilities are more expensive than the existing coal plants without taking additional backup generation and transmission costs. Add these in, and there’s no contest; Coal is King.

Unleash the Power of Coal

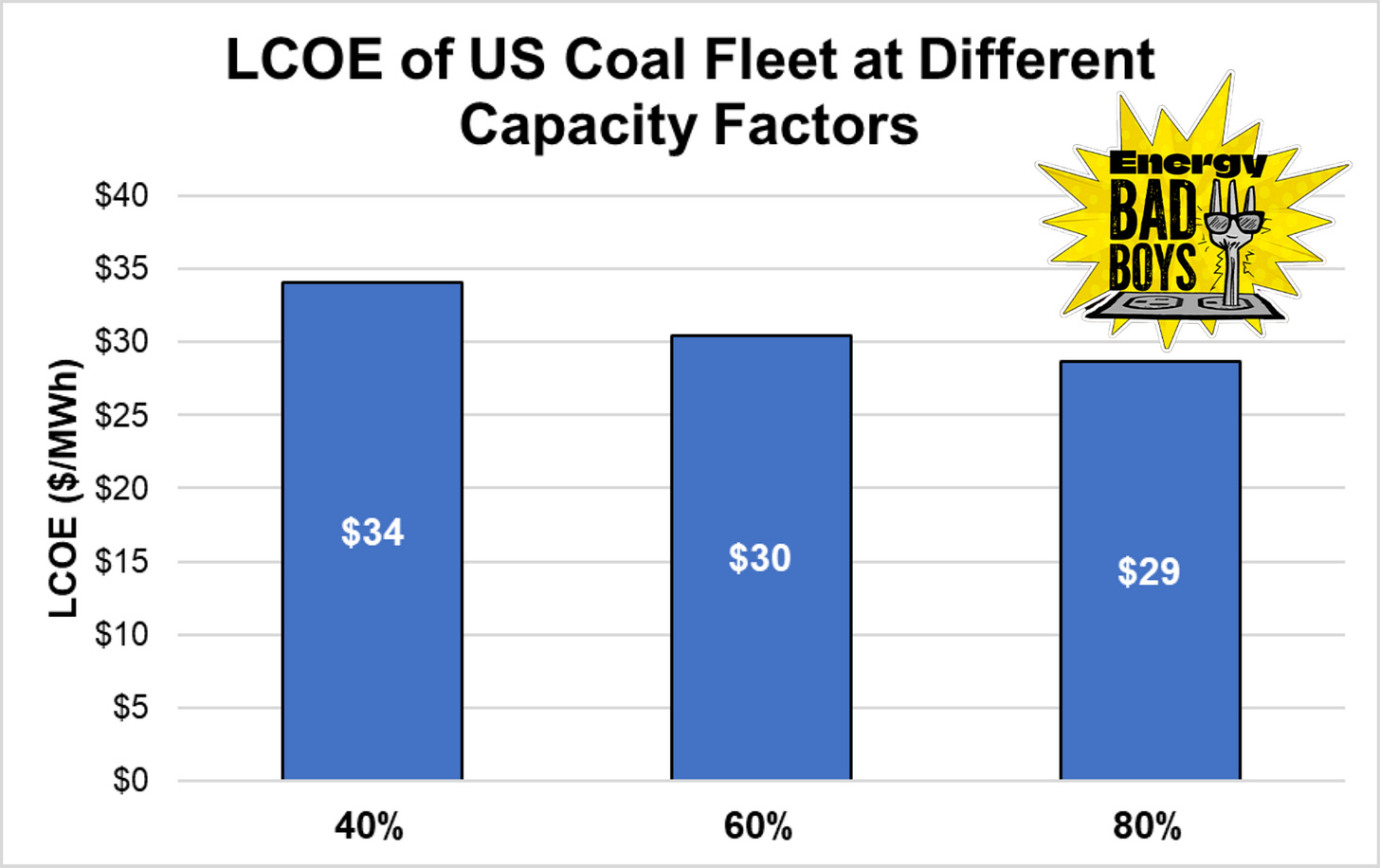

As low as the cost of coal is, it could be even lower. As we have detailed in our articles on the Levelized Cost of Energy (LCOE), the cost of generating electricity from any power plant boils down to the costs of running the plant (fuel costs, labor, capital repayment, etc.) divided by the number of MWhs generated.

Many states and utilities artificially reduce the run times on their coal fleets, resulting in a fleetwide average capacity factor of only 42 percent and thereby increasing the cost per MWh. In some instances, this is due to policies designed to reduce carbon dioxide emissions, like seasonal operating agreements signed in response to pressure from wind and solar special interest groups, and in others, it's because of low wholesale power prices or grid congestion due to wind and solar.

If not for these policies, coal plants could operate at higher capacity factors. In fact, most of them did just a few weeks ago. A study by Energy Ventures Analysis (EVA) found that the coal fleet operated at 80 percent of its capacity factor during the late January cold snap. If the coal fleet were able to run on “set it and forget it” mode, the costs could be as low as $29 per MWH on average.

The graph below shows the cost of operating the nationwide average coal plant at different capacity factors. As you can see, the more they run, the less each MWh costs.

Reliability: Coal Keeps the Lights On

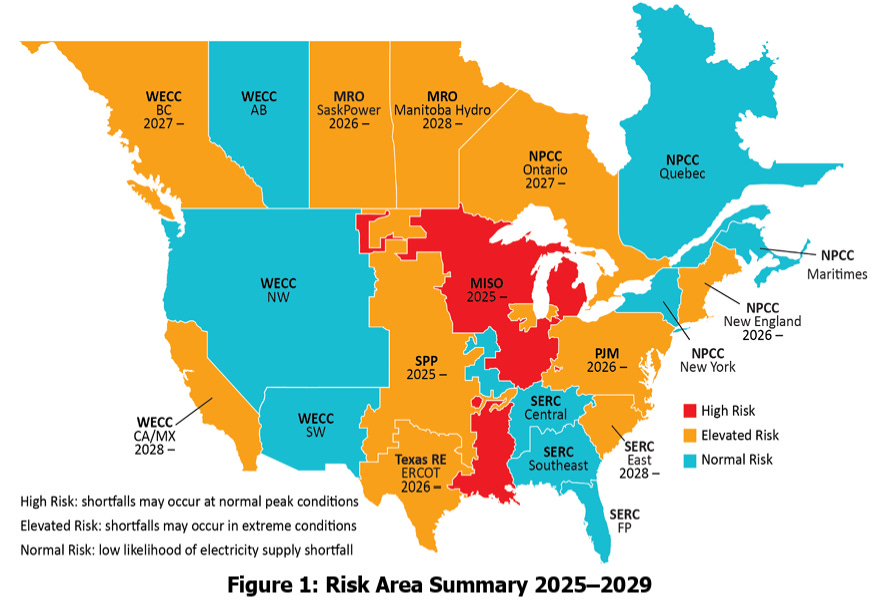

According to the Long-Term Reliability Assessment (LTRA) produced by the North American Electric Reliability Corporation (NERC), most of the American bulk power system faces mounting reliability challenges due to surging growth in demand and the announced retirement of thermal generators.

In other words, the U.S. electric grid is in a reliability hole, and the first thing we need to do is stop digging. The best way to stop digging is to stop closing down the coal plants that are vital to keeping the lights on, especially in the Midcontinent Independent System Operator (MISO) region, which is at the highest risk of rolling blackouts in the country.

The existing coal plants came in handy during the January cold snap. According to the EVA report mentioned above, the coal fleet increased its output in the MISO region during the January Polar Vortex relative to the month prior.

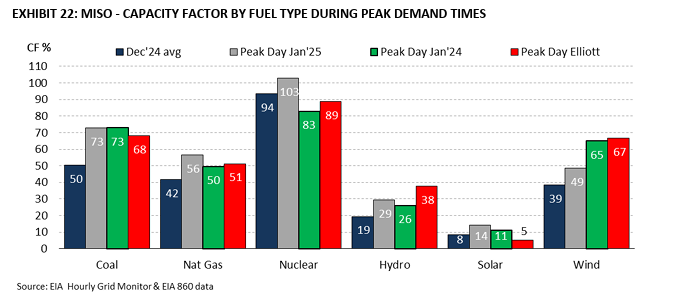

The graph below shows MISO’s coal fleet increased from a 50 percent capacity factor to a 73 percent capacity factor in response to higher demand and plummeting temperatures.

In comparison, natural gas increased from 42 percent to 56 percent, nuclear increased from 94 percent to 103 percent, hydro increased from 19 percent to 29 percent, solar increased from 8 to 14 percent, and wind increased from an average of 39 percent to 49 percent during peak demand.

This data suggests that the region’s coal fleet is playing an essential role in showing up under adverse conditions and reducing the region’s dependency on natural gas, which is subject to fuel supply interruptions and price spikes during extreme cold snaps. Of course, wind and solar aren’t “fuel-secure”, either, because their output depends on the weather.

Resiliency: Onsite Fuel Storage

An underappreciated aspect of coal plants is the fact that they offer massive quantities of energy storage, and most of us (Meredith Angwin excluded) don’t even think about how valuable this is for reliability.

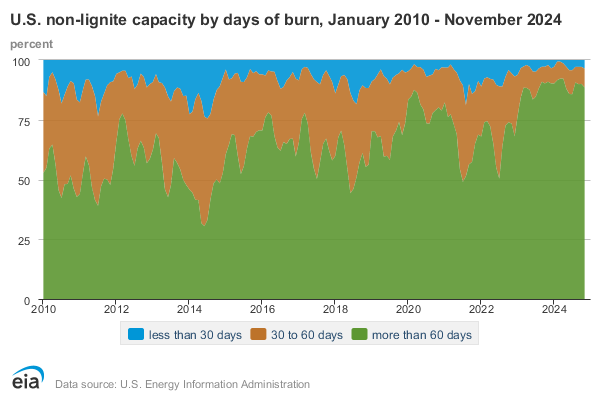

The U.S. Energy Information Administration (EIA) notes that U.S. coal power plants generally stockpile much more coal than they consume in a month, with more than 90 percent of coal-fired power plants currently having enough coal on hand to generate electricity for 60 days or more, which you can see in the graph below.

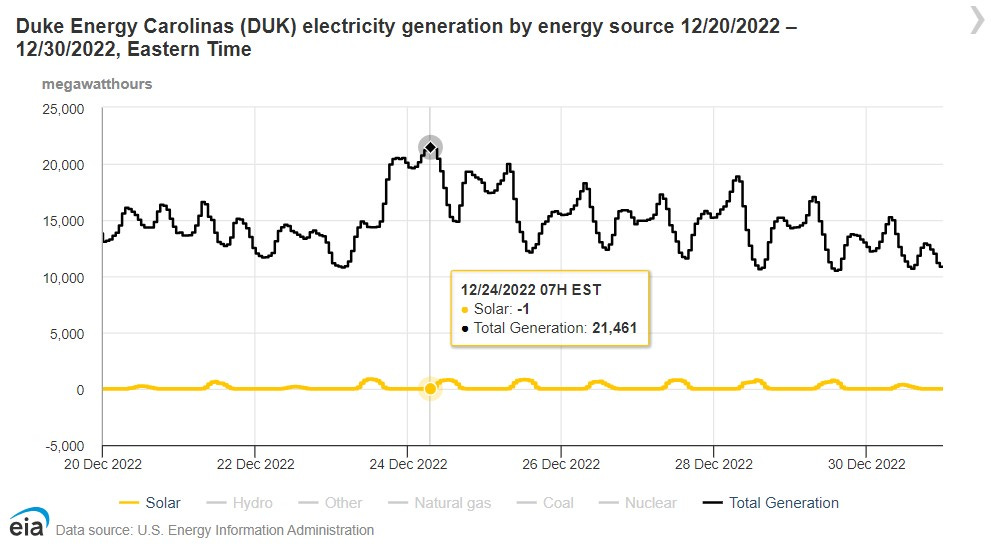

As we have noted before, Winter Storm Elliot caused rolling blackouts in the Southeastern United States due to disruptions in the natural gas fuel supply and the fact that solar power isn’t useful for winter peaking systems because electricity demand is highest at night when the sun is never shining.

It would be interesting for DOE or some other government agency to evaluate what would have happened during blackout events like Elliot or Uri if the coal fleets online in the mid-2010s hadn’t been retired. Using a metric like the Value of Lost Load to determine economic damages from blackouts could counterbalance the Social Cost of Carbon and help demonstrate the value that coal plants play in keeping the system reliable.

On-Site Fuel Storage: Billions Better than Batteries

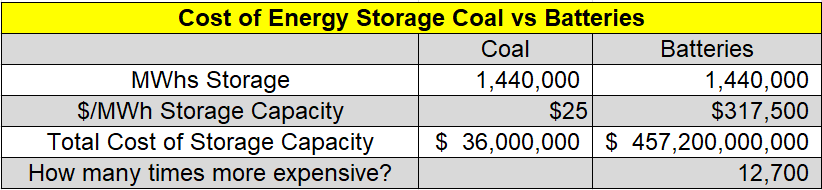

Coal offers on-site fuel storage for a fraction of the cost of battery storage. According to EIA data, the average coal plant has more than 60 days of fuel on-site, which means the average coal plant has 1,440 hours of storage on-site. This is an enormous amount of energy storage when we consider that many grid-scale batteries have just four hours of storage capacity.

If we compare the cost of the energy stored at a coal plant to the cost of storing the same amount of electricity with batteries, we quickly find that coal is delivering billions of dollars in benefits to the entire electric system for pennies on the dollar.

Let’s say we have a 1,000 MW coal plant with 60 days' worth of coal on-site (1,440 hours of storage). Based on EIA data, it costs about $25 in fuel costs to generate electricity using coal in a sub-critical coal plant, which means this plant could theoretically produce 1.44 million MWh of electricity during this 60-day period with a fuel cost of $36 million.1 That sounds pretty steep until we compare it to battery storage.

Battery cost data from the U.S. Energy Information Administration’s Assumptions to the Annual Energy Outlook shows a cost of $1,270 per kilowatt of four-hour battery storage. Dividing this value by four gives us a cost of $317 per kWh of storage capacity, which translates into $317,000 per MWh.

This means that building enough battery storage capacity to provide the same amount of energy as the coal plant with 60 days' worth of fuel on-site would cost $457 billion, or 12,700 times more than coal.

Even if we wanted to compare the cost of coal and battery storage over an assumed 20-year useful lifetime for the battery storage and double the cost of coal to account for building the infrastructure for the coal pile and handling costs, we’re still looking at a total cost of $8.76 billion for the coal, compared to $457 billion for the batteries, and that assumes the batteries can charge for free.

We can debate the merits of the marginal utility of storing 60 days of fuel on-site versus, say, 14 days, but the undeniable fact is that anyone who advocates for battery storage for even moderately long durations isn’t serious. When compared to batteries, coal plants are providing billions of dollars in energy storage value compared to battery storage, and they are not being compensated for this attribute.

Why are the Coal Plants Closing?

If coal plants are so great, why are they closing down? The answer is federal regulations and state policies that promote wind and solar and punish coal plants, as well as the profit-seeking perverse incentives of monopoly utility companies.

This isn’t an exhaustive list, but federal Environmental Protection Agency regulations promulgated under the Obama administration, like the Mercury and Air Toxics Standards, Coal Combustion and Residuals rules, Effluent Limitations Guidelines, and, of course, the original Clean Power Plan forced many utilities to decide whether to retrofit or retire their facilities. Biden’s Clean Power Plan 2.0 also attempted to force coal plants to either install unproven carbon capture and sequestration technology by 2032 or agree to retire the plants before the end of 2039.

At the state level, 24 states have passed 100 percent carbon-free electricity mandates or established carbon-free goals, and investor-owned utilities are Green Plating their grids and seeking to retire their depreciated coal plants and build as much new capacity as possible to maximize their corporate profits.

BRING THEM BACK

Delaying the closure of the nation’s coal fleet is a good first step. DOE should also identify possible candidates for recommissioning shuttered coal facilities so they are available to help the United States meet the massive electricity demand of data centers and new manufacturing facilities.

Some Ideas to Stop the Coal Closures

Repeal Biden-Era Regulations: Repealing the Biden-era regulations on carbon dioxide emissions from coal and natural gas plants will be a necessary but not sufficient step to keep the plants running.

Repealing the regulations won’t be sufficient because utilities like APS are using these regulations as justification for claiming there will be a price on carbon dioxide emissions in the future. Therefore, APS is incorporating these carbon prices into its Integrated Resource Plan modeling so it can make billions of dollars in profit by shutting down its coal plants and building thousands of megawatts of wind, solar, and battery storage.

Withhold Subsidies: Repealing the “Inflation Reduction Act” subsidies would be the best policy to prevent the EPA from justifying bad regulations in the future. But if that doesn’t work out, Republicans in Congress could use the upcoming reconciliation fight to disallow any federal subsidies from going to electric utilities that prematurely retire their coal plants. What constitutes “premature” will be the sticking point, but basing it on undepreciated capital costs and book life would probably be good enough for government work.

Conclusion

America’s coal plants are vital to providing the power we all rely upon. They will be an indispensable part of meeting surging power demand in the coming decades as artificial intelligence, data centers, and manufacturing increase their demands on the power grid.

It is immensely encouraging that the United States has an energy secretary who understands the country’s energy needs and is not afraid to advocate for keeping our reliable, affordable, and fuel-secure coal plants running for the foreseeable future.

RMI Led The Push To Ban Gas Stoves. Why Is It Getting Millions In Federal Funding? by

. Robert takes it to the Rocky Mountain Institute, and it is glorious. Alberta has another close call thanks to the disappearing wind and solar resources on its grid.US Should Stop Closure of Coal-Fired Power Plants, Wright Says by Bloomberg. This one was probably pretty obvious.

Based on EIA fuel costs of $2.51 per MMBtu and a heat rate of 10 MMBtu per MWh.

This is the properly researched case that fleshes out my speculations about the perilous state of all the grids in the world where net zero policies are in place.

What I call the" wind drought trap" is set when subsidised and mandated intermittent energy drives out conventional power to the point where there is barely enough to serve the base load.

The trap is sprung by windless nights when there is a peak load and unscheduled outages of conventional power.

There is a 'frog in the saucepan' effect because the problem is not apparent as long as there is spare coal and gas capacity.

Then the collapse can be very sudden, like Britain in June 2021 when a serious Dunkkelflaute occurred, and also Texas in February 2021.

You might have expected someone would check the reliability of the wind supply before they went into large-scale wind farming in the way that you would check the rainfall of a district before you bought a property to grow crops and pasture. But they managed to be surprised by the European Dunkelflautes that can last for weeks, and sailors and millers must have known about them for centuries.

https://www.flickerpower.com/images/The_endless_wind_drought_crippling_renewables___The_Spectator_Australia.pdf

I like to think of wind droughts as the loose thread in a knitted garment and if you pull on the thread long enough the whole garment will unravel.

The silence of the meteorologists on the matter of wind droughts makes me very suspicious because they must know that high pressure-will systems are associated with low winds. We know that the WMO was a founding member of the climate alarmist club in the UN when they established the IPCC.

The first assessment report of the IPCC in 1990 recommended a survey of the wind resources of the world in case they could be exploited for large-scale power generation. They must have found wind droughts and they must or should have known that this would disqualify wind power as a basis for reliable power supply until adequate storage technology is available. They wanted to destroy the economies of the West by getting rid of fossil fuels and unexpected wind droughts would deliver a fatal blow when the fossil fuel supply fell below the base load.

President Trump will be very cross if he finds out that this was indeed the plan and this could help to destroy the climate fraud if the Musk mafia can get into the records of the met offices and find incriminating communications from the WMO. That would totally discredit the WMO and their associates in the heart of darkness and justify the withdrawal of funds from all of the offending UN agencies.

www.flickerpower.com/images/RAFE_CHAMPION_CAN_THE_US_ESCAPETHE_WIND_DROUGHT_TRAP_The_Spectator_Australia.pdf

and they can of four days on in

The AI [boom, war, marketing campaign, investment hype] provides a great chance to monetize keeping coal going. Running a coal plant at a high load and using power excess-to-demand to run a data center should be quite profitable for the state or utility that could take it on. It has already been done for bitcoin "mining", and would work well (is working) for natural gas.

In my Peaky by Day, Stargate by Night essay, I tried to do a quick run at it:

https://open.substack.com/pub/winston866100/p/peaky-by-day-stargate-by-night?r=o86ng&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

My utility has an immense facility located a couple hundred miles away, with three generator plants around a roughly triangular coal field. It is mostly mothballed. I think if it was run at half capacity, my electric bill would be about 30% lower (after deleting wind and solar overcharges and tariffs). I'd love to see them running, and I think the working community there would be thrilled to get the work.

Nice piece!