This week, we were invited to present on the state of the Midcontinent Independent System Operator (MISO) for the Energy Policy Research Foundation’s Electricity Policy Working Group. The purpose of the working group is to discuss specific remedies for meeting rising electric power demand at the lowest possible cost.

Here are ten slides from our presentation that lay out the current state of the MISO system and the challenges it will face in the future.

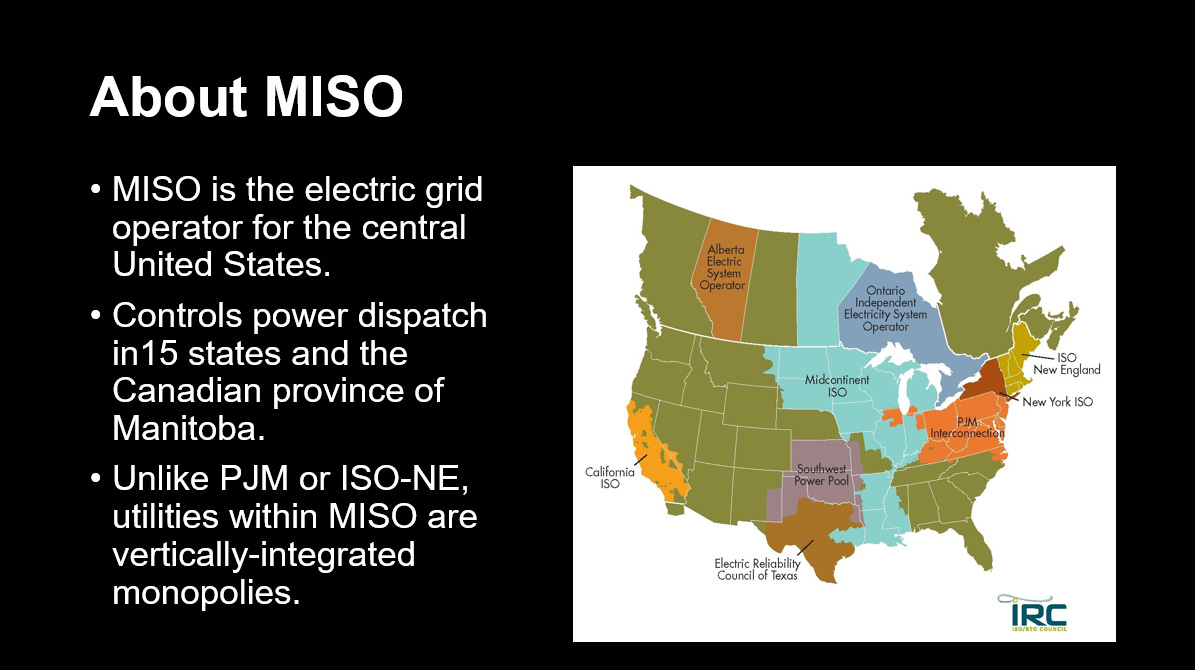

As we’ve noted before, MISO is the regional transmission organization (RTO) serving all or parts of 15 U.S. States and the Canadian province of Manitoba. In total, 42 million people depend on MISO to provide reliable power to their homes and businesses.

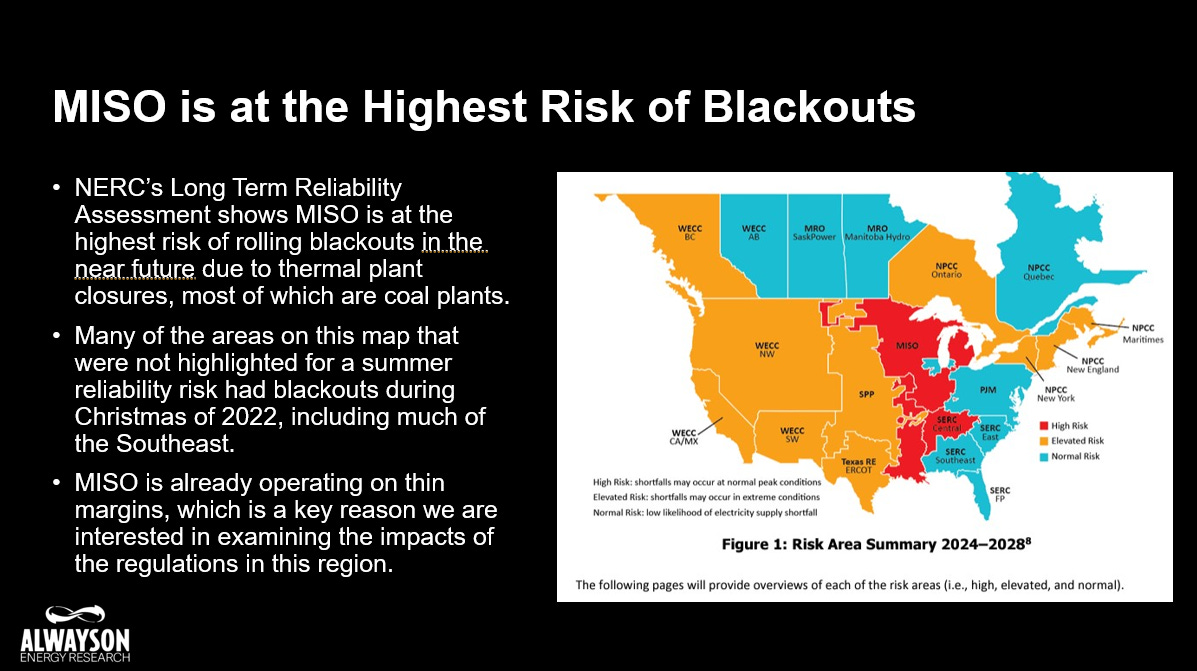

According to the North American Electric Reliability Corporation’s (NERC) Long-Term Reliability Assessment (LTRA), MISO is the region most at risk of rolling blackouts from 2024 to 2028, and the trends moving forward make it unlikely that the situation will improve.

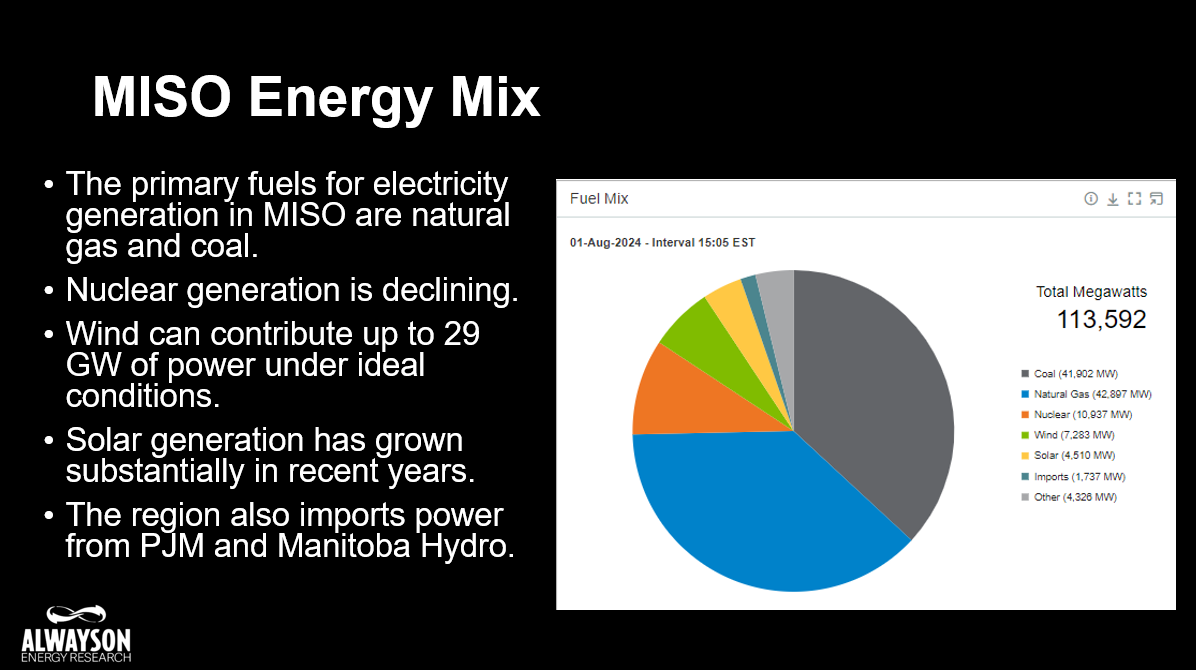

MISO is currently heavily dependent upon natural gas and coal to keep the lights on. On August 1st, these resources contributed 38 and 37 percent of the electricity demand, respectively, while nuclear accounted for 10 percent, wind, 6 percent, solar, 4 percent, imports, 2 percent, and other, which includes hydroelectric, oil, and battery storage, accounted for 4 percent.

Last week’s generation is consistent with MISO’s estimation for the summertime.

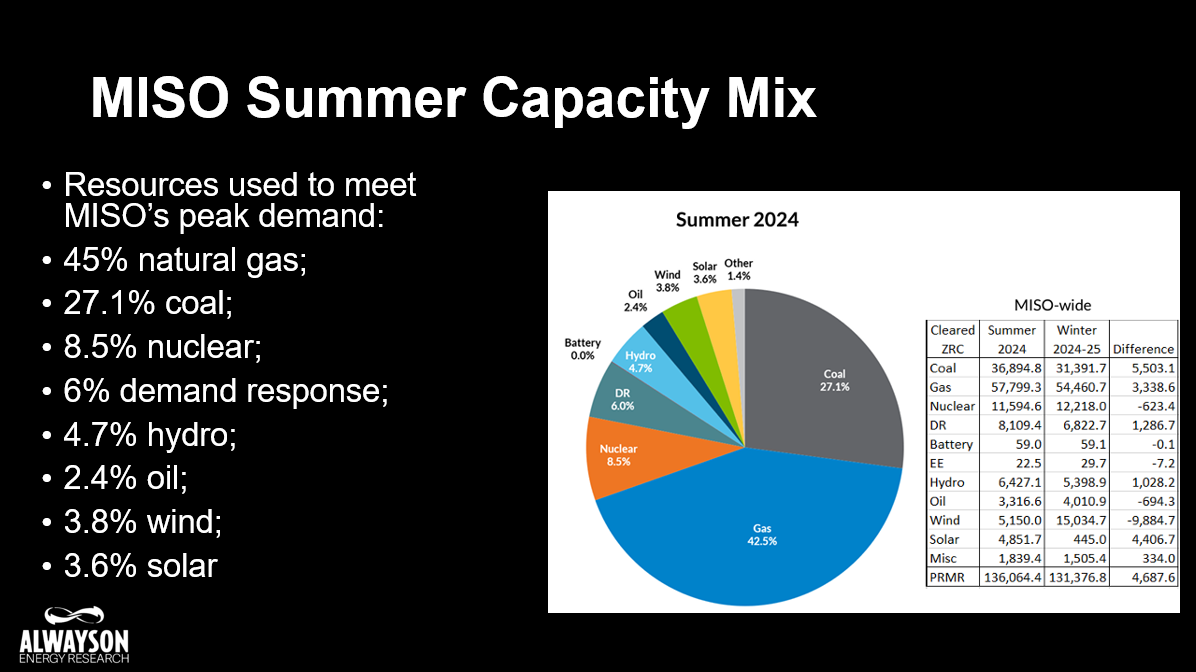

According to the MISO Planning Reserve Auction results (PRA), the RTO relies on natural gas to meet 45 percent of its reserve margin capacity obligation, 27.1 from coal, 8.5 percent from nuclear, 6 percent from demand response, 4.7 percent from hydro, 2.4 percent from oil, 3.8 percent wind, and 3.6 percent solar.

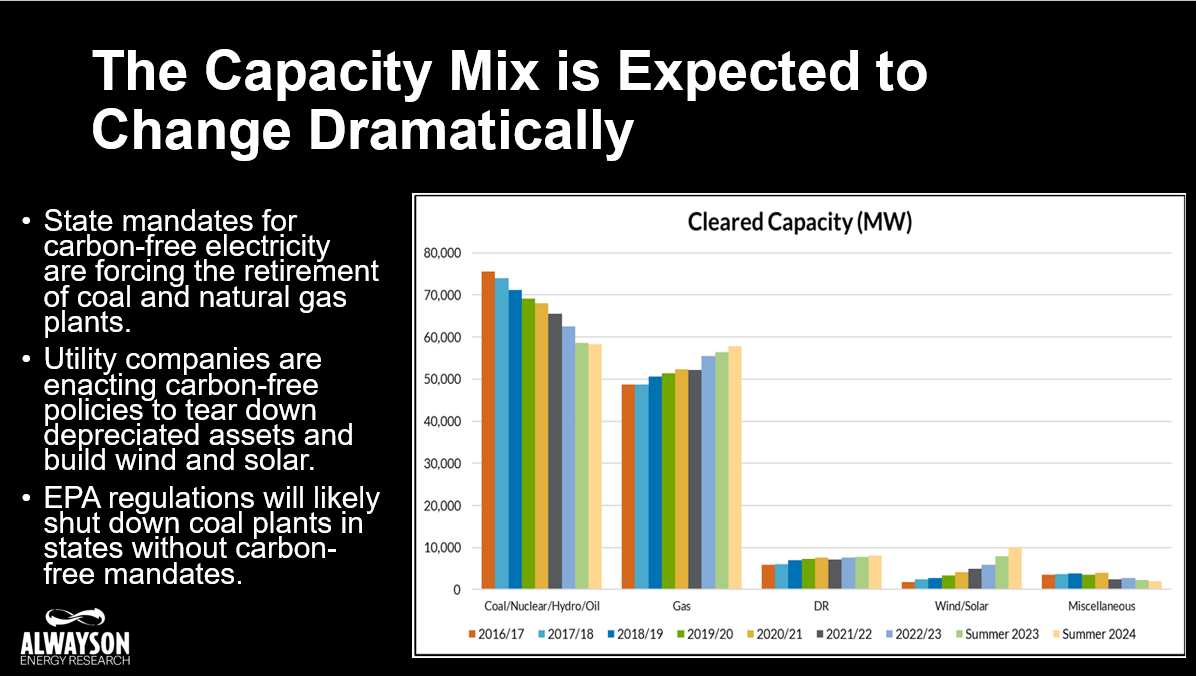

These capacity resources are expected to change dramatically. According to the PRA, MISO has already seen a substantial reduction in the amount of coal, nuclear, hydro, and oil capacity since the 2016-2017 planning year, while natural gas has filled some of the gap. Demand response has increased slowly but steadily, and wind and solar now account for 10,000 MW of the cleared capacity on the MISO system.

The retirement of thermal units is likely to continue due to utility companies attempting to green-plate their grids to maximize profits, the EPA’s regulations on carbon dioxide emissions on existing coal and new natural gas plants, and state decarbonization policies.

In the last few years, Illinois, Michigan, and Minnesota have enacted legislation requiring that 100 percent of electricity come from carbon-free electricity, and Wisconsin Governor Tony Evers signed an executive order to the same effect.

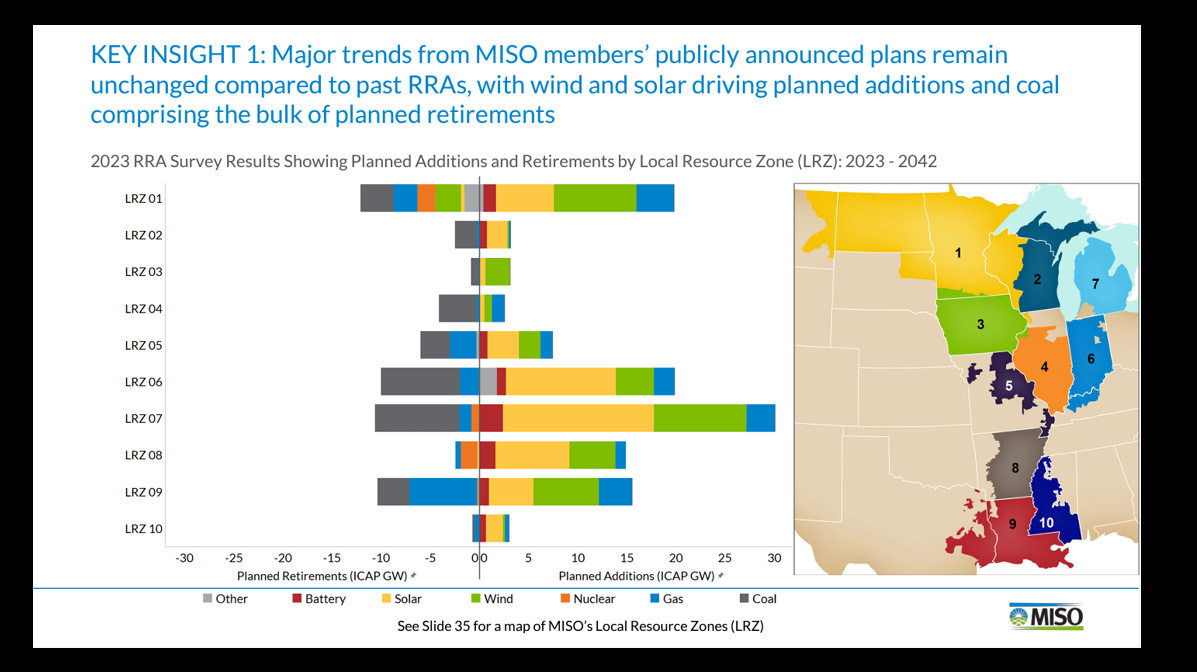

In total, these states account for approximately 46 percent of the demand in 2024 for the MISO system. According to the 2023 Regional Resource Assessment report, each region will see a substantial decrease in coal capacity, which will be largely replaced with wind, solar, natural gas, and battery storage.

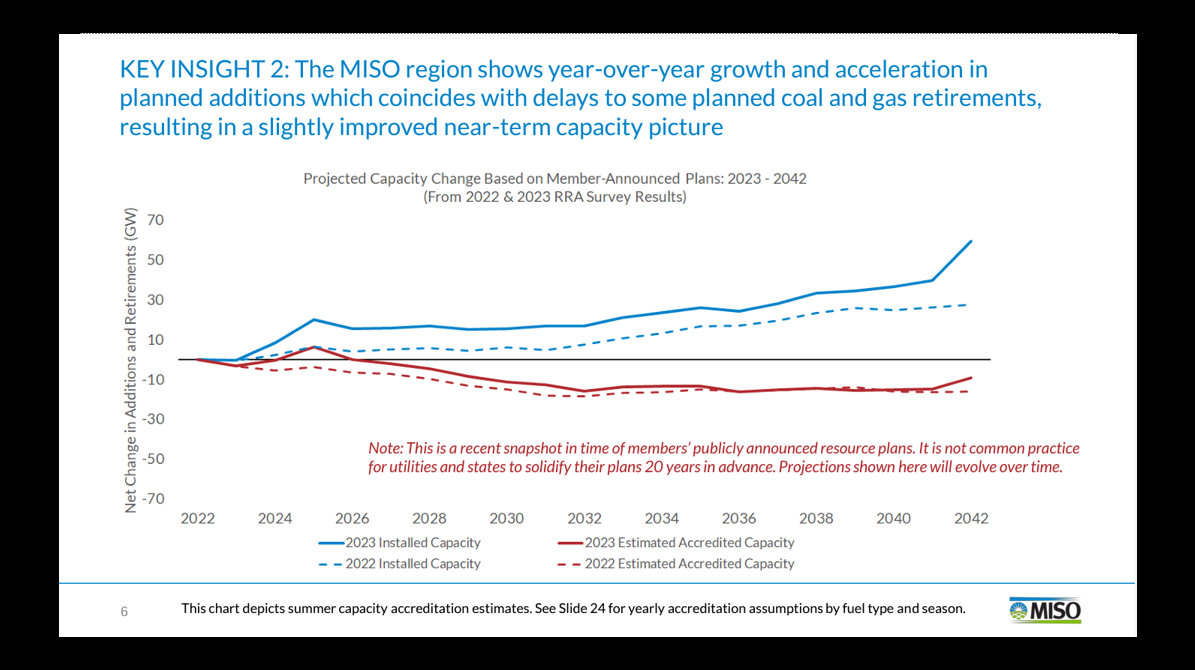

This results in a situation where there is more installed capacity on the MISO system, but there will be less accredited capacity that can be relied upon in future years.

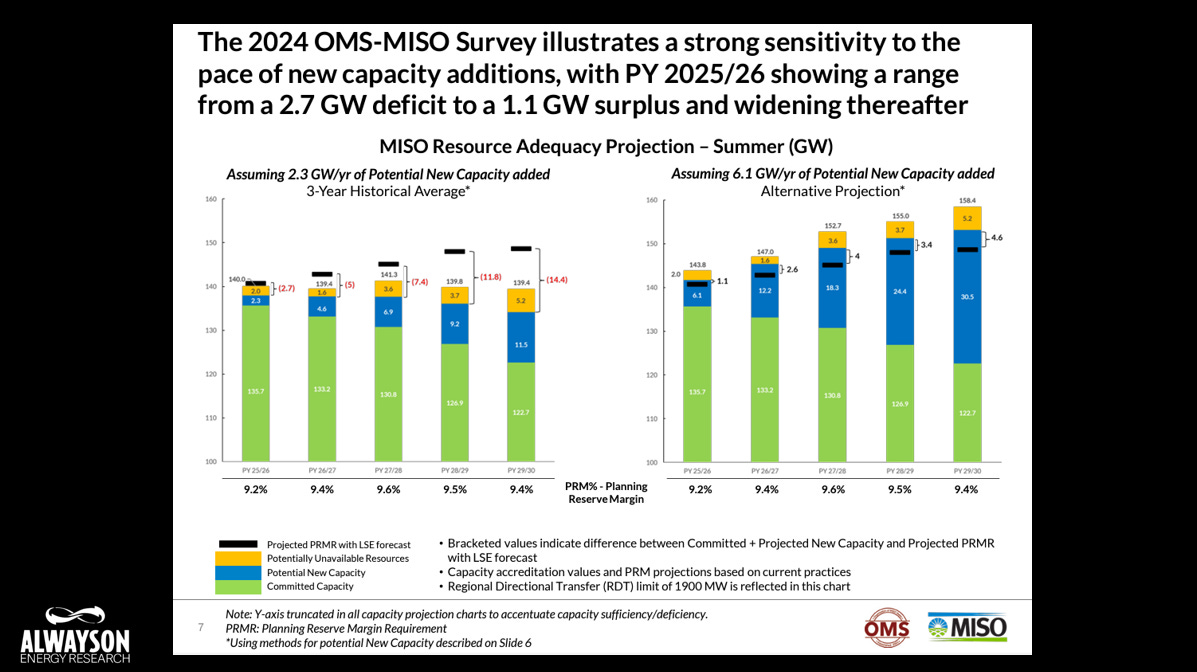

The Organization of MISO States 2024 Survey indicates this erosion of accredited capacity means MISO could face capacity shortfalls as soon as next year.

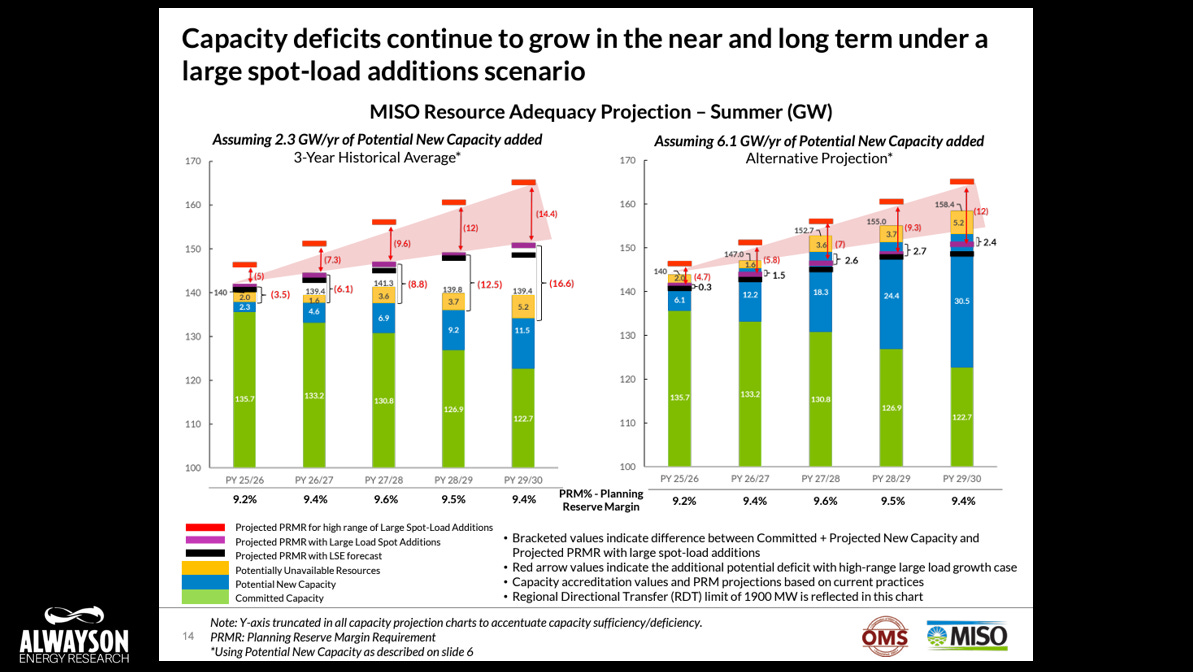

If thermal retirements continue in MISO and new capacity additions are consistent with the three-year historical average of 2.3 gigawatts (GW) per year, MISO faces a potential capacity shortfall of 2.7 GW for the 2025/2026 planning year, and this could grow to 14.4 GW by planning year 2029/2030. For context, this would be the peak demand of the entire state of Minnesota or Wisconsin.

If 6.1 GW of new accredited capacity enters into service each year, or roughly 2.65 times more than the three-year historical average, there is a chance to avoid capacity shortfalls. That is, until MISO factors in the potential load growth from data centers and manufacturers.

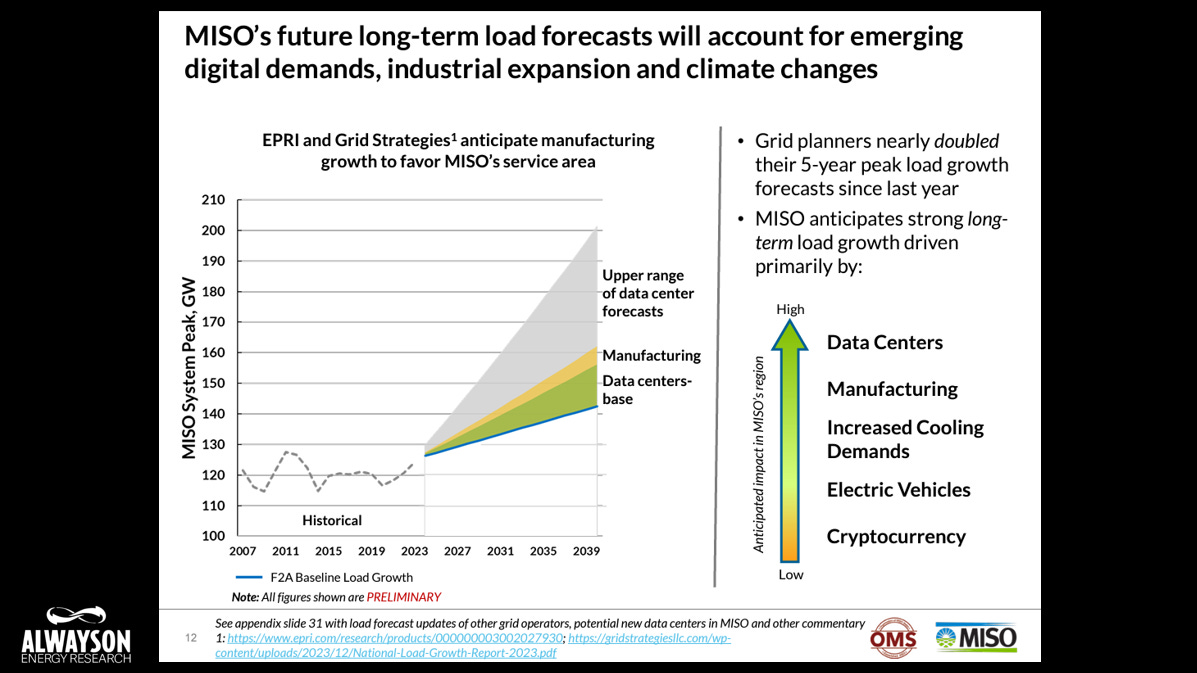

MISO has not historically factored these potential load growth sources into its demand forecasts, but now grid planners have nearly doubled their 5-year peak load forecasts compared to the previous year. By 2039, peak demand could grow from slightly more than 140 GW to 200 GW in the upper range for data centers forecast.

Data center load growth could compound resource adequacy problems in the near term, too. The OMS Survey indicates that large spot-load additions could increase the planning year 2025/2026 capacity shortfall to 8.5 GW, and the planning year 2029/2030 shortfall could reach more than 30 GW.

Obviously, something will have to give. The region will either need to scale back the scheduled retirements of coal, nuclear, and natural gas power plants to meet this rising demand or forego the economic growth that would accompany the increase in electricity consumption.

This reality exposes the silliness of arguments that rely heavily on demand response—or, as we like to call it, the opposite of Motel 6: We’ll turn the lights out on you—to keep the grid solvent. Not consuming energy comes at a cost, and states like Michigan are currently bending over backward to get these energy-hungry projects.

Unless MISO states get their energy policies in order, there won’t be any room at the inn.

Thank you for reading Energy Bad Boys! Please like, share, and subscribe so you never MIS-Out on future articles!

. A great primer on heat pumps.When You Are Ready for that Generator II by

PJM capacity prices hit record highs, sending build signal to generators by Utility Dive

It is almost as if the state governments are seeking to destroy their own economies via renewable and zero carbon mandates. apparently they haven't observed how Germany's Energiewende program is destroying the German economy, but they are going down the exact same road. Remarkable and incredibly stupid!

I live in Michigan. My spouse is employed as a consulting engineer, primarily on energy issues. Yesterday we installed a whole house generator. Our regulators seem determined to impoverish them freeze our state.