Last week, a Polar Vortex enveloped much of the Eastern United States, with temperatures in Boston approximately 13 degrees below normal for the coldest stretches.

During the event, the Independent System Operator of New England (ISO-NE) saw its peak demand pass 18,000 megawatts (MW) at 8 a.m. on January 22nd, approximately 2,000 MW below its estimated winter peak forecast under normal conditions and 3,000 MW under below-average temperatures.

To meet this demand, the Regional Transmission Organization (RTO) resorted to burning oil to keep the lights on. Modeling in our report, The Staggering Cost of New England’s Green Energy Policies, indicates that the New England grid of the future won’t be so lucky due to decarbonization laws and renewable portfolio standards in Connecticut, Maine, Massachusetts, Rhode Island, and Vermont.

Cold Snap Recap

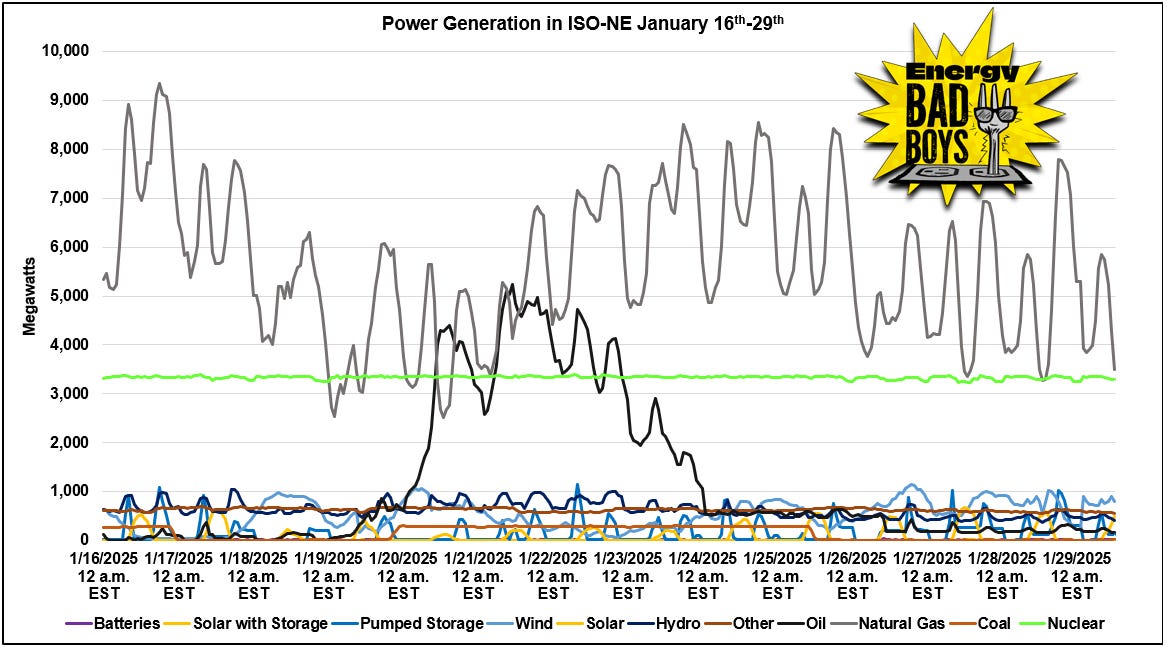

The graph below, which was made using U.S. Energy Information Administration (EIA) data, shows that, at one point, oil was the single-largest generator of electricity, keeping the lights on in ISO-NE last week, accounting for approximately 30 percent of generation at its peak. Even the coal plant in New Hampshire, which is slated for closure in 2028, fired up on January 20th to help shoulder the load.

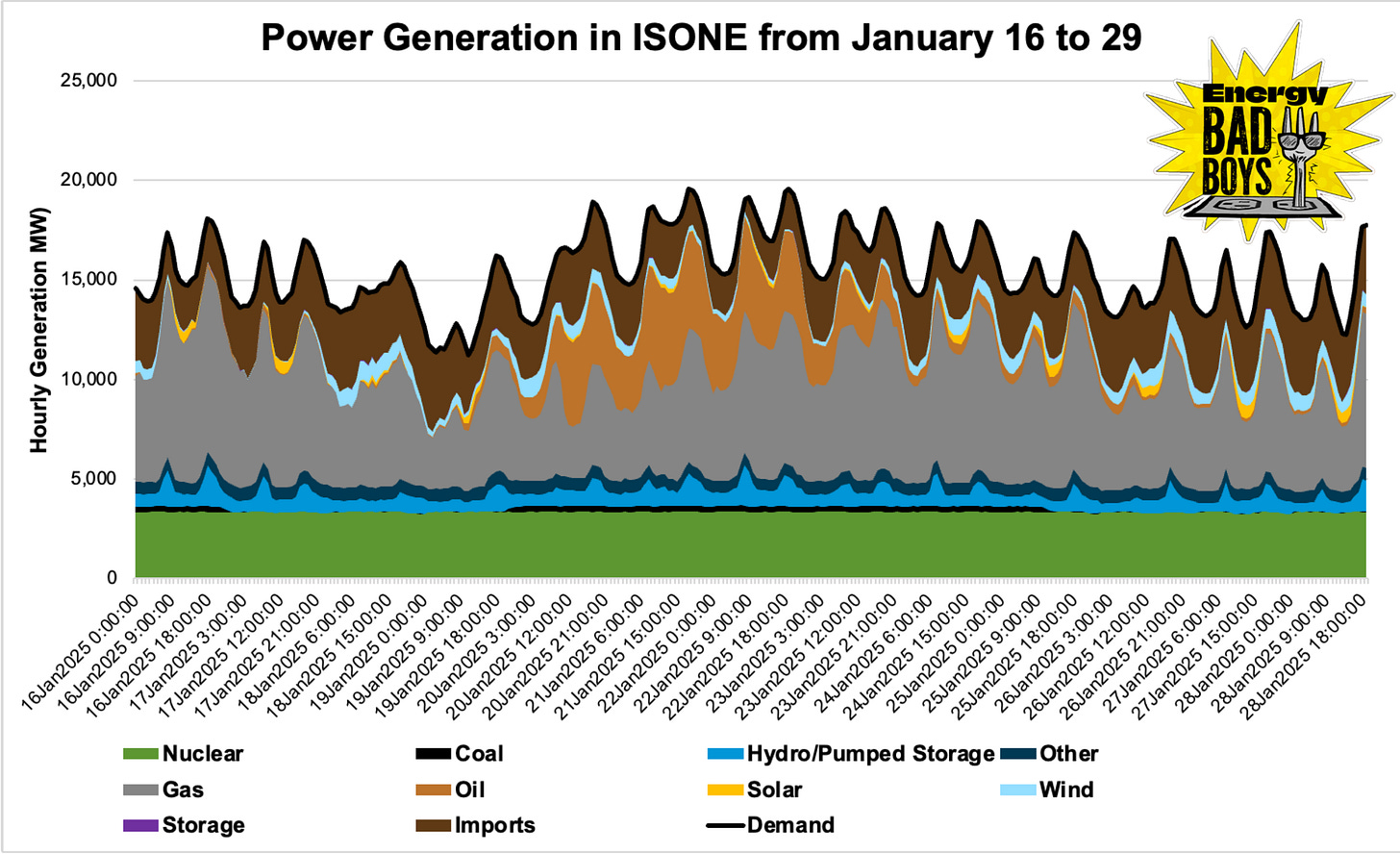

Here is an area graph of the same data, in case you prefer hard-to-interpret squiggles at the top of the graph instead of at the bottom.

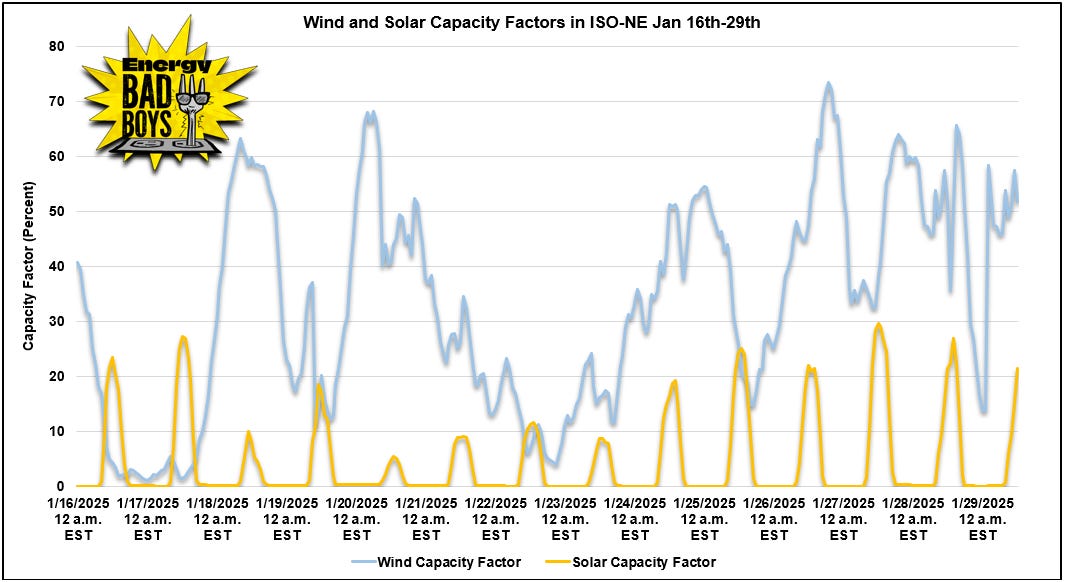

Meanwhile, wind and solar pulled a disappearing act.

After logging a capacity factor of 66 percent on January 20th, wind generation fell to 3.9 percent of its potential output at 9 pm on January 22nd. Solar generation was also lackluster during the cold snap, with a maximum capacity factor of just 5.1 percent on January 20th, 9.2 percent on the 21st, 11.6 percent on the 22nd, and 8.8 percent on the 23rd, which you can see in the graph below.

This type of performance simply won’t cut it in the future, when ISO-NE policies will make the grid heavily dependent upon offshore wind, onshore wind, solar, and battery storage to meet much of its hourly demand.

So, what will happen when the oil and coal plants aren’t there to kick around anymore? Let’s eff around and find out.

Looking Ahead

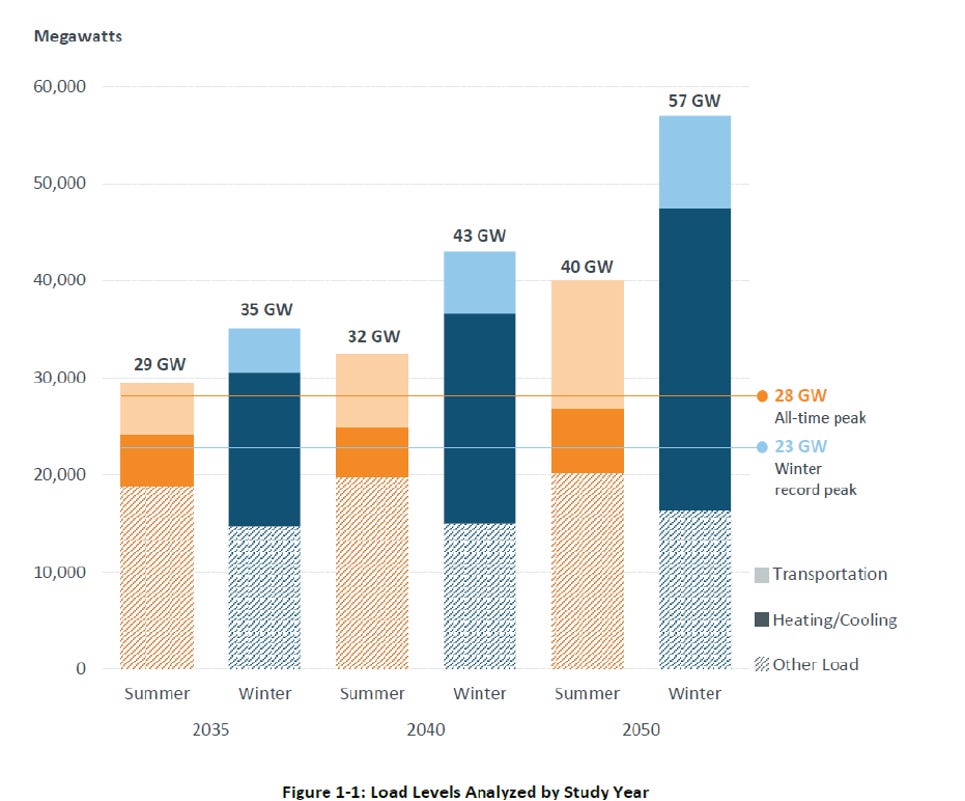

Last week’s cold snap was manageable because much of New England uses natural gas and fuel oil to heat their homes, keeping electricity demand in check. However, many of the states mentioned above are attempting to electrify home heating and transportation, which will greatly increase electricity demand and turn ISO-NE into a winter-peaking system.

By 2050, ISO-NE estimates the Winter Peak Load in the future could hit 57 gigawatts (GW) (there are 1,000 MW in a GW) with much of this demand growth due to electrification. A large portion of this demand will be home heating, which, combined with “other load,” would account for approximately 46 GW of demand.

The New England region would be hard-pressed to meet this growing demand even under the best of circumstances due to constraints on the regional supply of natural gas and state policies that prohibit or greatly restrict the construction of new nuclear power plants.

However, attempting to meet this demand with wind, solar, and battery storage will make this task even more difficult, and, based on our modeling, would fail to keep the lights on and add insult to injury by costing an additional $815 billion compared to today’s prices.

“The Grid of the Future”

In our analysis, we modeled a peak demand of 53 GW because we assumed that New Hampshire would continue to be the lone voice of sanity in New England and not require the electrification of its homes or vehicle fleets.

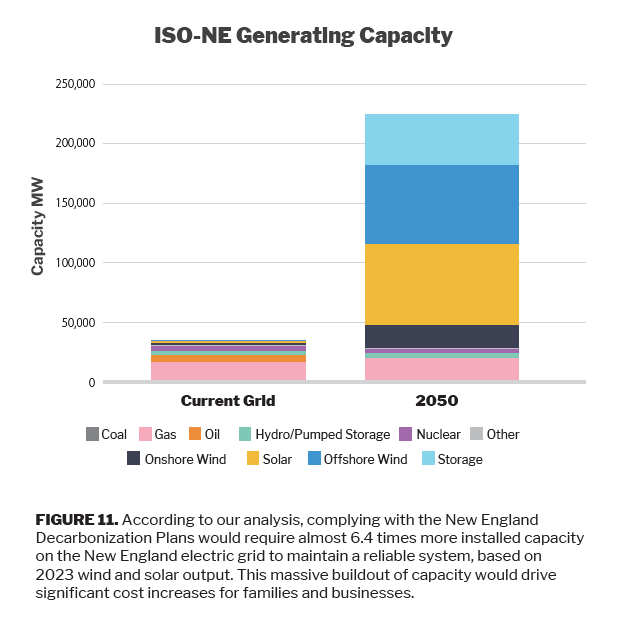

Our modeling indicated that meeting peak demand for every hour of the year while managing such a substantial increase in the winter peak will require a massive buildout of infrastructure.

The total installed capacity in 2050 would need to be 225.4 GW— more than four times higher than the peak demand— to meet the peak demand and maintain reliability for every hour of the year based on 2023 hourly onshore wind and solar capacity factor data. For offshore wind, 2019 hourly capacity factor data were used from ISO-NE variable energy data resources because more recent data was not available.

Of note, most of the coal and oil plants that were so handy last week would be retired by 2050, but they were replaced with more natural gas capacity. To make things easier, we assumed there would always be enough gas to run the power plants, even though we know that the region needs more pipelines.

While this additional gas capacity was enough to replace existing thermal plants, it isn’t enough to meet growing demand and ensure the availability of 24/7 reliable power.

Reliability Using 2023 Weather

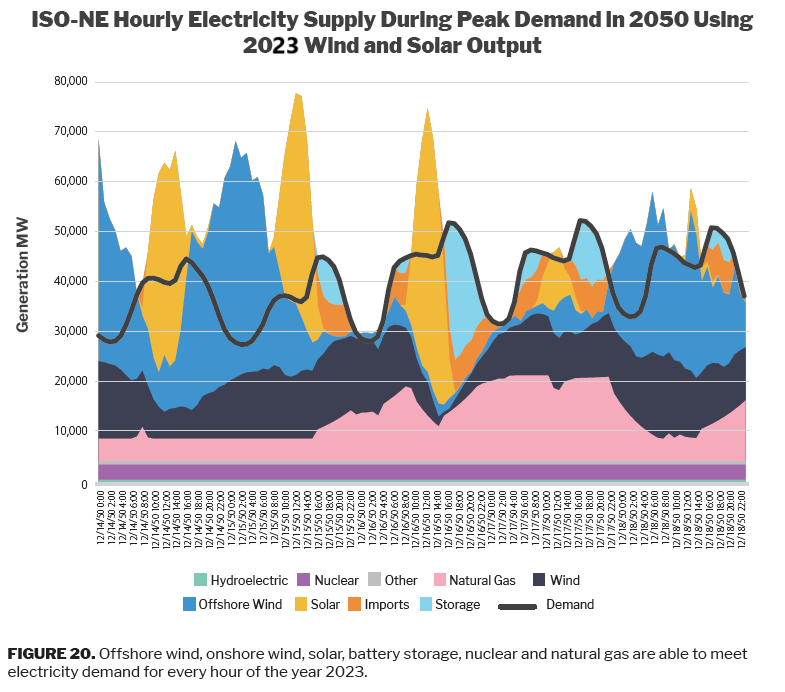

The graph below shows the hourly electricity demand for December 14th through December 18th, 2050. Power demand in the graph is based on the 2033 load profile dataset published by ISO-NE, extrapolated to meet projected monthly peaks in 2050. Hourly offshore wind, solar, and onshore wind generation were used in the methodology described above.

As you can see, generation from offshore wind plummets on December 14th and stays low through the 17th; onshore wind disappears beginning on the 16th, but solar generation remains robust during this three-day stretch. At night, however, the region imports significant quantities of electricity from Canada —we assumed these imports would always be available, which is unrealistically charitable—and relies on battery storage.

All is well as long as the generation from offshore wind, onshore wind, and solar facilities in New England are the same as they were in 2023. However, intermittent resources have a pesky habit of never doing that.

With this in mind, our analysis stress-tests the system to gauge whether different weather years would present challenges to a grid heavily dependent on weather-based resources. It does.

Reliability Using 2019 Weather

Using the same electricity demand from the graph above but with 2019 hourly onshore wind and solar capacity factors instead of 2023, New England experiences a six-hour blackout with a maximum capacity shortfall of 22,528 MW. This is about 40 percent of the power demand in the region at that time.

As you can see, offshore wind, onshore wind, solar, battery storage, and New England’s existing nuclear and natural gas power plants are unable to provide enough electricity to meet demand, resulting in a six-hour blackout.

The capacity shortfall on December 17, 2050, is caused by low wind and solar output and insufficient battery storage capacity to store excess wind generation from previous days — even with more than 170,000 MWh of storage available. During this period, solar capacity factors were just one percent, onshore wind capacity factors were eight percent, and offshore wind capacity factors were five percent.

Poor performance among offshore wind, onshore wind, and solar, beginning on December 15th, spell doom for later in the week because there is not enough excess electricity generated from these resources to recharge the batteries. As a result, the batteries are exhausted late on December 17th, and blackouts ensue.

Conclusion

As we have noted many times before, relying on wind, solar, and battery storage to meet hourly electricity demand is gambling with the grid and the lives of those who depend on it.

When the wind fails to show up or solar doesn’t meet expectations, it’s lights out unless policymakers are willing to saddle their ratepayers with the cost of natural gas and oil plants needed to keep the grid reliable.

President Trump may have saved liberal New England policymakers from themselves last week by issuing a temporary withdrawal of all offshore wind leases, which sent a chilling effect rippling through the industry.

Hopefully, this action gives lawmakers the time and political talking points needed to legalize the construction of new nuclear power plants in their states. If New England lawmakers are going to ram decarbonization down the throats of their citizens, they might as well do it in the least stupid way possible.

Click Like, Share, and Subscribe, or you’ll have to live in New England.

. Robert has a great piece explaining the executive orders issued by the Trump administration. It is a must-read for anyone interested in this space.Wind and Solar Are At Odds with Growth by

TL:DR - wind and solar aren’t cutting it.Wall Street Wants You To Believe It’s Backing Away From ESG. Reality Paints a Different Picture by

. Jason details how big financial institutions aren’t backing away from ESG as fast or as far as they are claiming to.

And yet, several powers in the area insisted that it was absolutely essential to shut down Vermont Yankee some years ago, including RFK jr..

It would be nice if it didn't take more than 20 years for folks to do a little arithmetic.

Thank you for the analysis.

Please send this to governor Healy who presides over the state of Oz