"Mission Impossible": Why Getting Enough Minerals for Net-Zero is Impossible

Net-Zero policies will require more mining than activists may think

This week for Energy Bad Boys, we have a special guest post from Sarah Montalbano, in which we discuss her and Debra Struhsacker’s latest report on mining in Minnesota. While Sarah is the original author, EBB commentary has been woven throughout. We hope you enjoy!

Sarah is a Policy Fellow at the Center of American Experiment and author of her own Substack, Montalbano Mondays.

One of Isaac Orr’s first reports for Center of the American Experiment back in 2018 evaluated how environmentally responsible mining would boost Minnesota’s economy, which he co-authored with Debra Struhsacker, a cofounder of the Women’s Mining Coalition and hard rock mining policy expert. Last month, Sarah and Debra produced a new report for American Experiment entitled “Mission Impossible: Mineral Shortages and the Broken Permitting Process Put Net Zero Out of Reach.”

Why revisit mining in 2024? Because a lot has happened since 2022. Mining has never been more important to the U.S. than it is now. The economy of today and the future – much to the dismay of degrowth environmentalists – depends on our ability to mine valuable resources. Furthermore, if Net Zero goals are to be taken seriously, they could never be achieved without mining. Without an adequate supply of critical minerals, Net Zero by 2050 is doomed to fail before it even gets started — and weaken the reliability of our electric grid, endanger national security, and place an enormous burden on the U.S. economy in the process.

Here are some highlights of the report, and we highly recommend reading the full report for even more useful facts and figures.

Mission Impossible: What’s the Mission?

The report defines “Net Zero by 2050” as the 2015 Paris Agreement, where 190 nations, including the U.S., agreed to restrict global temperature increases to 1.5 degrees Celsius above pre-industrial levels by 2050.

The U.S. is currently enacting policies to this end: it is mandating that 50 percent of all new passenger vehicle sales be electric by 2030, and 100 percent by 2050. Other policies, like the EPA’s Clean Power Plan 2.0, are forcing the replacement of reliable, 24/7 dispatchable coal and natural gas power plants with weather-dependent, intermittent wind and solar resources. States like Minnesota have set their own goals for “clean” electricity by 2040.

The report doesn’t take a stance as to the costs or benefits of an energy transition, but looming mineral shortages and a lengthy, litigious permitting process make these goals impossible — at least on the ambitious timeline set by policymakers, if not entirely.

While the report doesn’t take a stance on the costs and benefits of an energy transition, the Energy Bad Boys certainly do. We’ve discussed often, and have shown through our modeling, how devastating an energy transition would be for America’s electricity grid and economy – even if it were possible. We’ve already seen the impact of deindustrialization in the home state of Tim Walz (and unfortunately Isaac) caused primarily by Minnesota’s expensive energy transition, which has only achieved 30 percent wind and solar levels. Imagine 100 percent.

Why Is It Impossible?

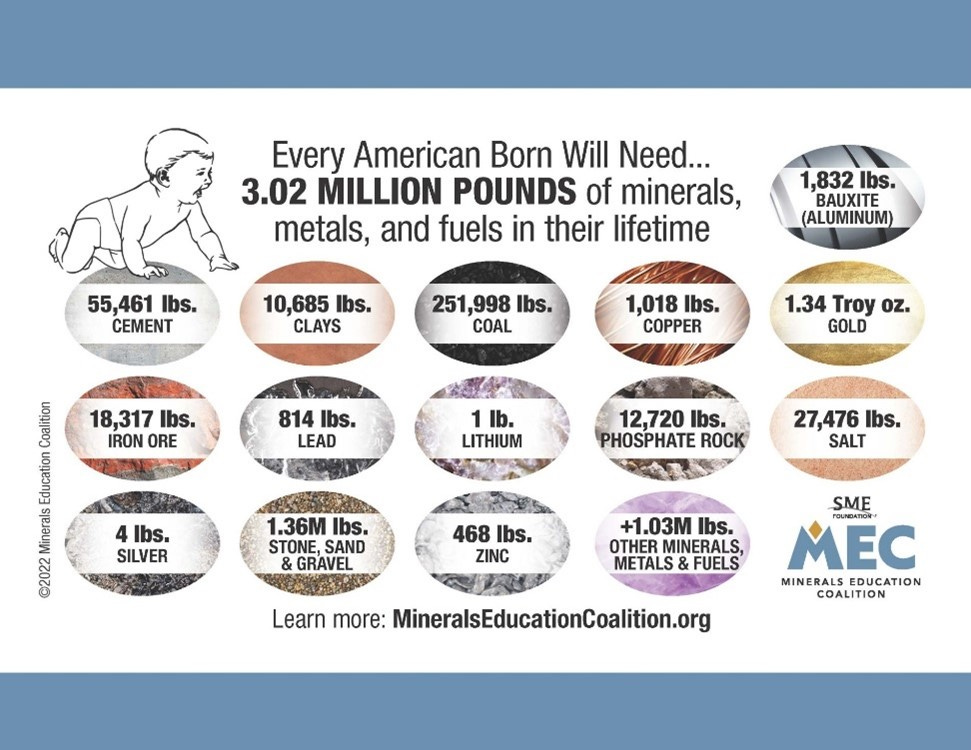

No one — or almost no one — truly appreciates the degree to which they are dependent on minerals for their standard of living. Every American uses 3.02 million pounds of minerals in their lifetime, as shown in the graphic below. That’s about 40,630 pounds per year, according to the USGS.

This is just business-as-usual. Net-Zero would require a lot more than this.

Critical Mineral Demands Now Outpace Supplies

Copper, nickel, cobalt, and rare earth elements (REEs) are just a few of the minerals needed to construct wind turbines, solar panels, battery storage, and electric vehicles. For example, a 3-megawatt wind turbine (the average size of a new turbine in 2021) requires nine tons of copper, 335 tons of steel, 1,200 tons of concrete, three tons of aluminum, and two tons of rare earth elements. An average offshore 3.6 MW wind turbine requires approximately 32 tons of copper.

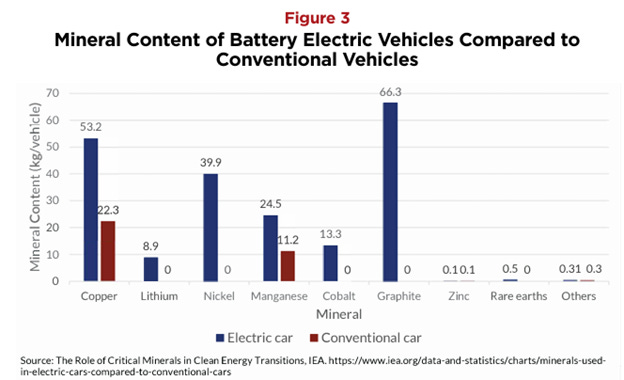

The key driver of mineral demand in the “energy transition,” however, stems mostly from battery electric vehicles, which use 80 kilograms of copper vs 22 kilograms for an average internal combustion engine (ICE) vehicle, as you can see below. Electric vehicles also need manganese, lithium, nickel, cobalt, graphite, and rare earth—minerals that aren’t required for ICEs. (Electric buses are even more mineral intensive, as they need 253 kilograms of copper).

Additionally, more copper will be needed for charging stations and transmission lines to accommodate growing EV adoption and wind and solar resources. In 2021, the U.S. used only 11 terawatts of electricity to charge EVs; by 2030, electricity demand is estimated to rise to 230 terawatts.

The 2022 Inflation Reduction Act has compounded U.S. demand for electrification minerals. An S&P Global report estimated that “energy-transition demand for lithium will be 15% higher by 2035 than projected pre-IRA; 14% higher for nickel; 13% for cobalt; and 12% for copper.” Plus, the IEA now predicts copper demand will outstrip supply after 2025, with cobalt and nickel shortages following after 2030. JP Morgan estimates that additional power consumption by data centers will expand global copper deficits by another 2.7 million metric tons by 2030, and Bank of America thinks data centers will add around 200,000 metric tons of copper per year between 2025 and 2028.

Hitting NZE by 2050 will require a mountain of minerals. Coupled with power-hungry artificial intelligence and data centers, mining enough new materials for Net Zero may require 50 new lithium mines, 60 more nickel mines, and 17 more cobalt mines constructed by 2030 (IEA). Other estimates suggest even more, costing anywhere from $360 and $450 billion.

The U.S.’ Dangerous Reliance on Foreign Mineral Supplies

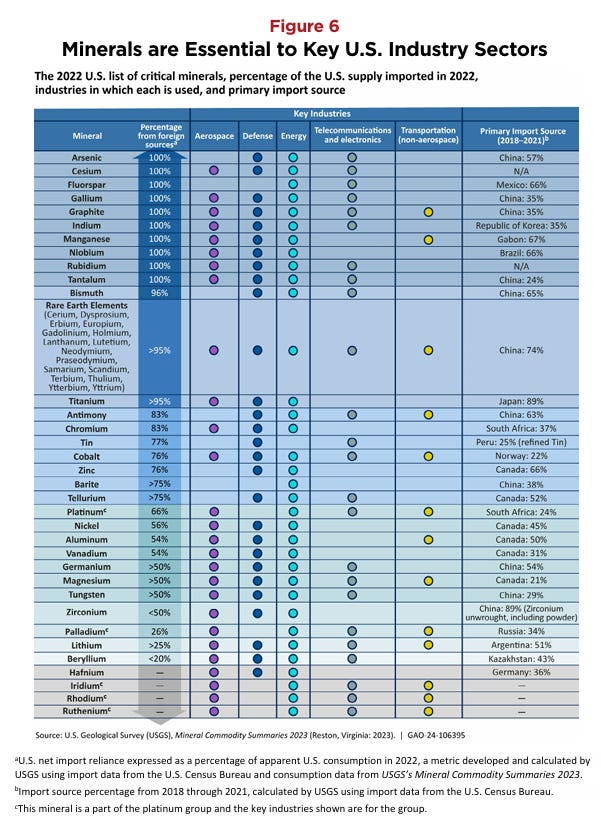

NZE policies also create national security risks concerning key minerals.

Minerals needed for wind and solar are also essential to key economic sectors including aerospace, defense, energy, telecommunications, electronics, and transportation – industries that are already over-reliant on foreign mineral supplies. Under current net-zero policies, this over-reliance would increase, as mineral demands for alt-energy are essentially competing for the minerals needed for these sectors, creating a dangerous and unsustainable situation.

Of 50 critical minerals recognized by the U.S. government, the U.S. was 100% import-reliant for 10 of them and more than 50% import-reliant for 31 of them (in 2022), as shown by the chart below, reproduced from the Government Accountability Office’s July 2024 report underscoring the seriousness of the situation.

The Department of Defense warns that in a conflict with China, the U.S. would face shortfalls of 69 minerals, 20 of which come primarily from China.

This reliance jeopardizes national defense and other critical industries because China has demonstrated its willingness to withhold critical minerals from the U.S by restricting exports of germanium, gallium, graphite, rare earth elements, and antimony.

For example, in July 2023, China restricted exports of gallium and germanium used in high-tech semiconductor chips, and antimony in August 2024, a key mineral for military applications. As a result, germanium exports dropped from 8.63 metric tons to a mere 1 kilogram, gallium exports fell from 5.57 metric tons to zero, and prices for antimony surged to a record high of $25,000 per metric ton.

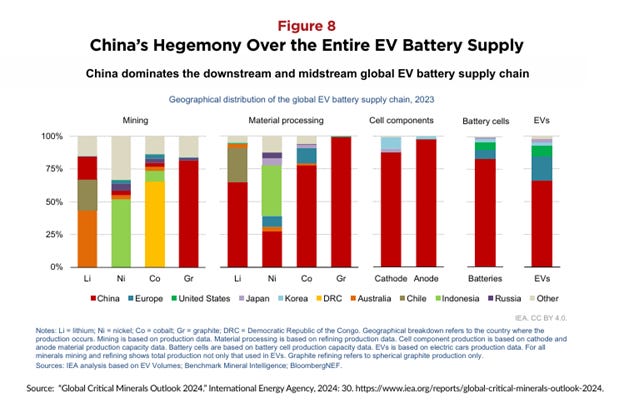

If proponents of NZE got their wish, America’s entire electricity grid would become beholden to the Communist nation, as well, because of China’s dominance in the supply chain for minerals. The graph below shows just one avenue of China’s dominance in the EV battery supply chain.

The (soon-to-be former) Biden administration claims that the solution is to import more from friendly nations. Yet importing from other friendly nations, like Canada, isn’t risk-free either. The U.S. relies on Canada for 66% of its zinc and 45% of its nickel. But Canada is likely to need at least some of its minerals for its own economy and energy goals, and with China’s deep ownership and investments in Canadian mining companies, the situation gets murkier.

The real solution is clear: mine in the U.S.

U.S. mines are among the safest and cleanest in the world, and mines in foreign countries may utilize child labor, like in some unregulated “artisanal” cobalt mines in the Democratic Republic of the Congo, which produces 65% of the world’s cobalt. Over a million children work in mines and quarries worldwide (IEA), and we should consider it abhorrent that the U.S. considers “out of sight, out of mind” an acceptable solution. If America needs more minerals, we have every incentive to mine at home.

Federal Policies Obstruct Mining and Land Access — and Impede Its NZE Goals

Permitting delays are a key reason that the U.S. is unable to grow its domestic mining industry and respond to growing national security risks from foreign mineral supplies.

The National Environmental Policy Act creates a lengthy, litigious, and politicized permitting process. NEPA requires federal agencies to analyze the impacts of any project that may affect the environment, including mining, wind and solar projects, oil and gas development, transmission lines, and more. This has the effect of slowing down and canceling critical projects, wasting millions of dollars and chilling investment. No company wants to touch Sarah’s home state of Alaska with a ten-foot pole anymore.

But, of course, it isn’t just oil, gas and mining anymore, it’s wind and solar too, which is why permitting reform is finally seeing some bipartisan support. The time that it takes for a renewable energy power project to move from proposal to construction has more than doubled since the early 2000s. Over one million miles of transmission lines would need to be built to achieve NZE by 2050 — a tall order at our current rate of about 700 line-miles per year.

Some quick math from the report spells it out clearly: “At this rate it will take 1,400 years to permit one million miles of transmission lines, dramatically illustrating that policymakers have embraced grossly unrealistic goals and timelines in which to achieve any semblance of an energy transition.”

It’s not just NEPA holding back projects.

A great deal of land, especially in the West, is off-limits to public access — and federal policies are making this worse. The Bureau of Land Management (BLM) recently finalized its Public Lands Rule, which creates a novel provision allowing third parties to lease lands for “conservation” and “mitigation,” where lands can be put off-limits to the public for up to a decade. BLM is facing legal challenges from five states (Alaska, Montana, North Dakota, Utah, and Wyoming) as well as various groups of public lands users.

BLM also recently proposed its Western Solar Plan, which pits utility-scale solar energy development against mining and other uses of land on 31 million acres of 11 western states. Except for mining claims where a formal claim validity examination has determined that there is a discovery of a valuable mineral deposit, solar development is prioritized over ongoing mineral exploration and development.

The report details more than ten federal policies within the Biden-Harris administration’s tenure that have damaged domestic mining and access to public lands.

Conclusion

The energy transition has been a disaster for some time, but the argument in favor of it becomes even more ridiculous when you consider that those advocating for it the most are also preventing the domestic mining development required to achieve it without endangering national security through reliance on foreign minerals.

The U.S. makes a value judgment every time it decides it would rather offshore the environmental and worker health and safety impacts of procuring the minerals it needs. The energy transition is a mistake on operational ability alone, and that it comes at the cost of compromising our values is even more of a reason to oppose it.

Like this piece to support domestic mining, public land access and streamlined permitting.

Share, subscribe, and comment below to share your thoughts on mining

Thanks for the excellent write-up, codifying what many have seen across different reports before. But I think it is clear the situation.

You write "If proponents of NZE got their wish, America’s entire electricity grid would become beholden to the Communist nation, as well, because of China’s dominance in the supply chain for minerals." Given that those most keen on energy transition have shown themselves to be communists in all but name, it is clear that is their ultimate goal.

With luck, under the new Trump administration, many of these impediments will be removed and the US will be able to utilize its natural bounty of assets effectively and arguably in the most environmentally sound manner possible.

Thank you Sarah and EBBs. Your subscribers may also be interested in this presentation by Mark Mills: https://www.youtube.com/watch?v=q7Gi0vObVSo

The prices of a wide range of commodities can be tracked here: https://tradingeconomics.com/commodities There are a few puzzles: copper is only up 7.9% on the year, lithium down 39%. Silver is another to watch for its use in photovoltaics and a hedge, like gold, against economic rough seas; up 32%. Germanium fits the picture, up 93%.

I would hope that some folk would find the book ' Material World: A Substantial Story of Our Past and Future' by Ed Conway as fascinating and eye-opening as I did.

A final personal comment: the scale of central government intrusion in our lives is oppressive,, coercive, negative in its effect, and (faint hope) could do with massively reining in (I write from the UK where the degree of acceptance of this is alarming).