Electricity Prices Are Soaring: It’s Time to Hold the “Energy Transition” Accountable

Rate cases throughout America tell the same story about the high cost of going green

Electricity prices in the United States are skyrocketing, with all-sectors electricity rates reaching new all-time highs in 2022 and 2023, but wind and solar advocates like to pretend that these energy sources are not responsible for the rising electricity costs paid by American families and businesses.

However, recent reports from Regulatory Research Associates (RRA), a division of S&P Global Commodity Insights, evaluating requests from electric companies to raise their prices (known as rate cases) clearly show that rising electricity prices are largely being driven by spending billions of dollars on wind turbines, solar panels, natural gas plants, and new transmission lines in pursuit of the so-called “energy transition.”

Our deeper-dive into the eight largest rate increase requests, as identified by RRA, reaffirms these findings by quoting directly from rate cases filed with state regulators, debunking the idea that wind and solar aren’t causing electricity rates to rise, once and for all.

Rate Making 101

Before we discuss the individual rate cases, it is important to understand that there is no free market for electricity, and there may never be.

In much of the country, electric companies are government-approved monopoly utilities that have the exclusive right to sell electricity in their service territories. Because electric companies are monopolies, it would be unfair to let them charge whatever they wish for electricity, so electricity prices are set by government regulatory bodies that oversee utilities, often called Public Utilities Commissions (PUCs) or Public Service Commissions (PSCs).

When electric and gas utility companies want to raise prices on customers to pay for additional expenses, they must file rate cases with the PUC or PSC that justify the additional expenses in the company’s request.

These additional expenses frequently consist of building new power plants, such as wind turbines, solar panels, or natural gas plants, as well as the additional ten percent profit utilities make on virtually every new asset they build and the cost of interest used to finance the construction of the plants. If the additional expenses outlined in the rate case are approved by the PUC or PSC, electricity rates go up for customers.

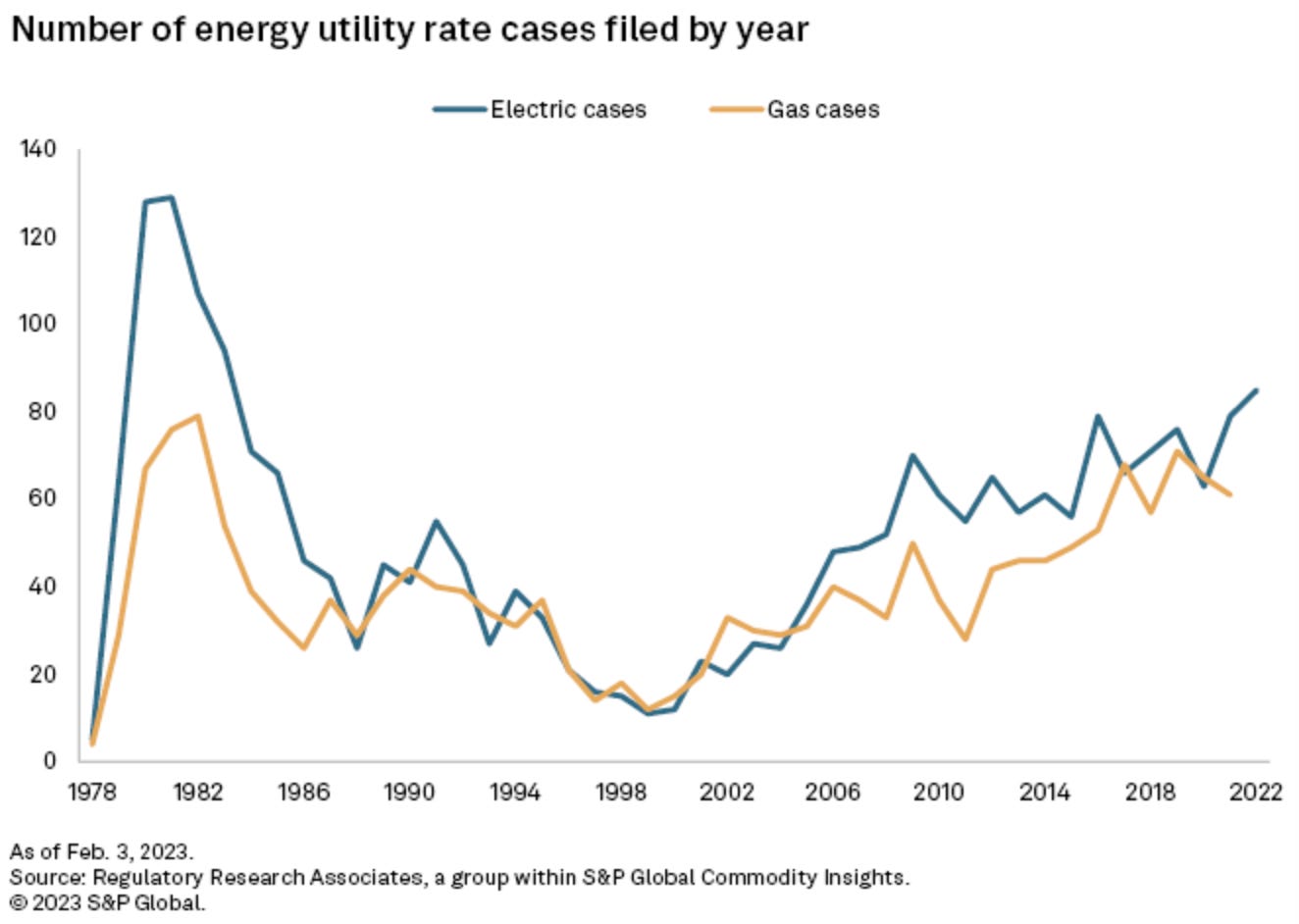

Rate increase requests have skyrocketed in recent years, according to the RRA reports, and so has the amount of money that electric companies are looking to raise from them.

Show me the Money! The largest rate increase requests on record

The graph below from the RRA documents shows the number of rate increase requests filed by American utility companies by year. There has been a steady increase since the early 2000s, with over 80 rate increase requests filed in 2022, which was the highest in 40 years.

As of September 2023, there were already 63 electricity rate cases filed across 28 states and the District of Columbia, suggesting the upward trend seen in the graph is the new normal.

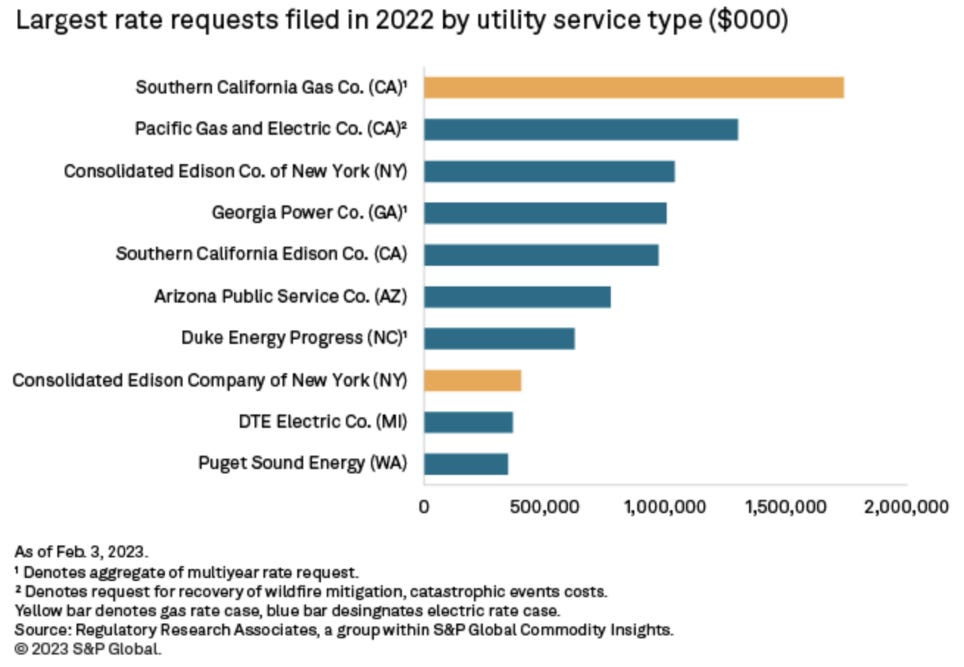

It’s not just the number of rate increase requests that are rising, but also the dollar amounts behind those requests. The graph below shows that 2021 and 2022 were the largest annual increases on record, in inflation-adjusted dollars, with 74 percent of 2022 proposed rate increases being driven by electric utility requests.

Additionally, 2023 is on pace to smash both 2021 and 2022. According to RRA, utility rate increases totaled nearly $24 billion by the end of Q3 2023, exceeding all of 2022 by $7 billion.

Unsurprisingly, these rate increases are beginning to show up in customer electric bills, as EIA data show that the U.S. average monthly residential power bill increased by 15 percent from 2020 to 2022, rising from $117 to $135 per month. If 2023 is an indication of the future, then consumers will continue to endure higher electricity bills for the so-called “energy transition.”

The rate cases tell the tale: The “energy transition” causes rising prices

The term “energy transition” is an opaque phrase that often means different things to different people, but the general idea is that it is a conscious decision by policymakers, utility companies, wind and solar non-profits, and grid operators to retire existing plants they consider “dirty” - mostly fossil fuel and sometimes even nuclear power plants – and replace them with some kind of “clean” mixture consisting of primarily wind, solar, battery storage, and new natural gas, to reduce greenhouse gas (GHG) emissions.

The graph below from RRA shows the companies with the largest rate increase requests in 2022, eight of which were for electric rate cases. We searched through each of the most recent rate cases proposed by these eight companies to discover their reasoning for requesting such substantial price hikes.

Our deep dive into the rate cases found that every single one of the eight companies listed wind and solar investments or the energy transition as one of the primary reasons for raising electricity prices, and multiple companies explicitly cited state mandates for clean energy or GHG reductions to justify the rate increases.

Pacific Gas and Electric Co. (CA)

Pacific Gas and Electric, frequently referred to as PG&E, had the largest electric rate increase in the country in 2022. The company began its proposal with the following justification for its rate case:

We present crucial safety investments to reduce wildfire risk and provide safe, reliable, and clean energy service for the 16 million customers we are privileged to serve across northern and central California. We request the California Public Utilities Commission (Commission) to authorize an increase in our electric and gas rates and charges effective January 1, 2023, to collect the revenue needed to serve our customers.

Further down, PGE highlighted its first-ever “Analysis of Climate Change” with the following opening statement:

PG&E remains committed to California’s bold climate and clean energy goals and to actions that reduce greenhouse gas emissions, including delivering low-carbon energy. In 2020, about 85% of the electricity we supplied to customers was greenhouse gas free. PG&E also continues to support our customers in their climate goals through programs and incentives for energy efficiency, clean energy transportation, solar energy, and battery storage.

This commitment “to California’s bold climate and clean energy goals” has been costly.

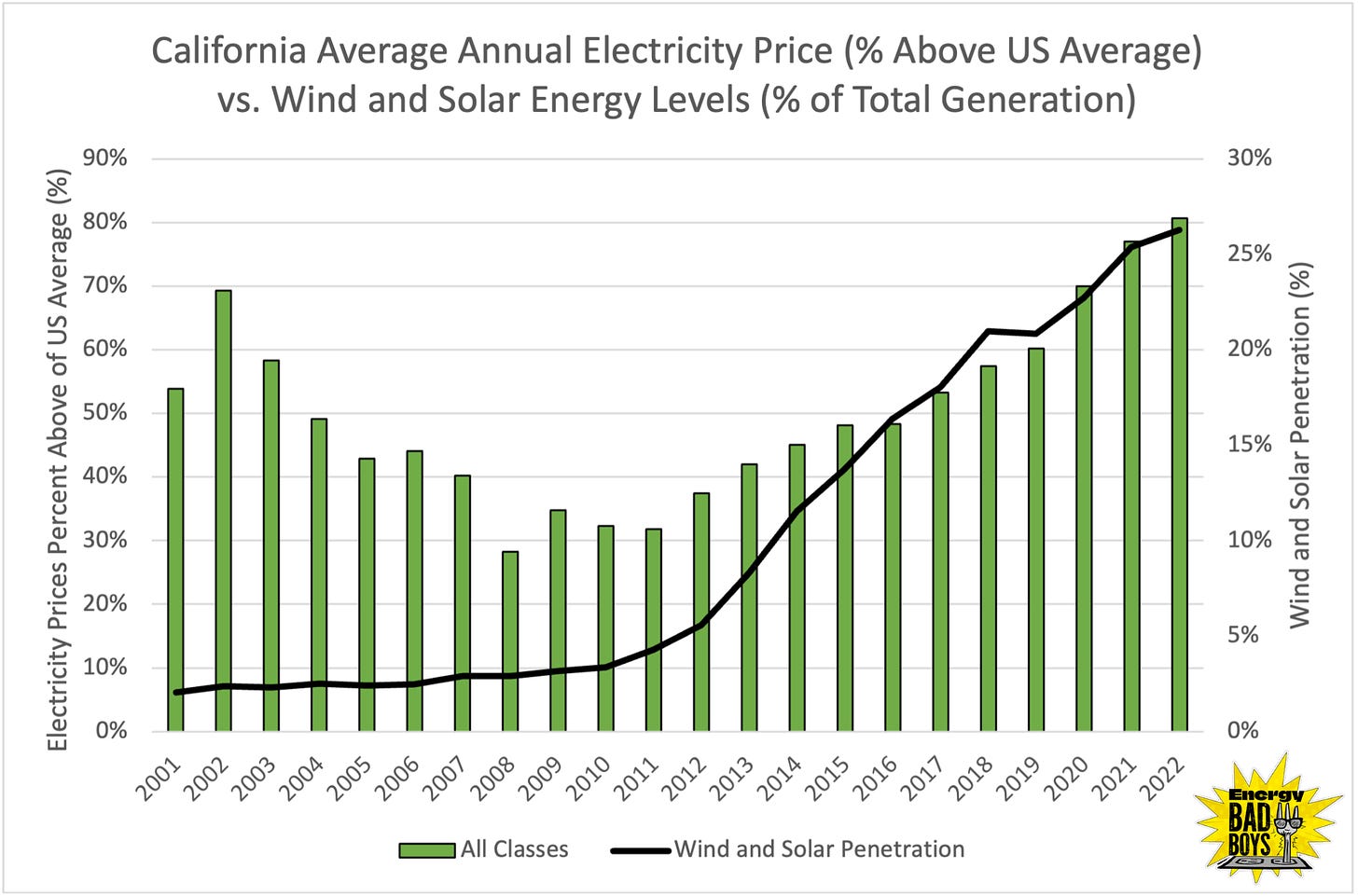

As wind and solar energy penetration levels began to rise above 5 percent, California electricity prices began skyrocketing, erasing nearly a decade of price normalization with the US average. In 2022, with wind and solar generation levels above 25 percent, the average electricity price in California was 81 percent higher than the national average, compared to a low of 28 percent in 2008 when the Golden State’s generation mix only had 3 percent wind and solar.

Consolidated Edison Co. of New York (NY)

The opening paragraphs of Consolidated Edison, frequently called “ConEd,” rate case request state:

New York State is leading the way to a clean energy future. By taking bold action through the Climate Leadership and Community Protection Act (“CLCPA”) to reduce emissions and support disadvantaged communities, the State is building a sustainable energy future for all New Yorkers.

Con Edison shares the State’s vision and is committed to making it a reality. To do that, we are proposing new electric and gas rate plans for January 2023 that will help fund investments to bring large-scale clean energy resources to our customers, reduce emissions, and facilitate increased electrification.

ConEd’s motivation for filing a rate case is straightforward, it needs to increase costs on consumers to comply with “the State’s vision” of a “clean energy future.” A story in Politico reports that these energy policies are expected to cost New York state $48 billion in the coming decades.

Georgia Power Co. (GA)

Georgia Power Co also listed clean energy investments as a primary reason for its rate increase request.

Since the approval of the 2019 base rate case and through the end of 2022, the Company expects to have invested approximately $8.6 billion on behalf of our customers, which includes investments that support enhanced reliability and resiliency in the electric grid, transitioning the Company’s generation fleet to more economical and cleaner resources, technology to enhance operations and our customers’ experience, and compliance with state and federal environmental regulations.

Later on, the company explained further that the rate increase “includes considerations for:”

The need to continue transitioning the Company’s generation fleet to more economical and cleaner resources, including renewables, with a proposed deferred recovery of a portion of depreciation expense associated with the generating units that the Company proposes retiring after 2025 as set forth in the 2022 IRP.

To understand the last part about depreciation, energy transitions involve the premature retirement of perfectly useful, inexpensive coal and nuclear plants. Doing so requires speeding up the depreciation expenses that are charged to ratepayers and were originally calculated using a much longer economic lifespan.

Here’s an explanation from the rate case under the headline, “Economic Fleet Transition with Clean Energy:”

An increase of approximately $249 million in the Company’s revenue requirement associated with the fleet transition can be primarily attributed to the net increase in depreciation expense related to the change in depreciation rates, additional purchased power expense in 2024 and 2025 related to the purchased power contracts requested to be certified in the 2022 IRP, capital investments in solar, hydroelectric, and other renewable generation assets, and increase in DSM expenses associated with its programs and initiatives filed in the 2022 DSM Certification application…

In its 2022 IRP filing, the Company proposed to retire or make unavailable the following coal-fired generating units: Wansley 1-2, Bowen 1-2, and Scherer 1-3, and replace them with more economical generation resources. Consistent with this proposal, the depreciation rates established in the 2019 base rate case Order must be adjusted to reflect the updated useful lives of these assets in support of timely recovery of the Company’s related capital investments and removal costs. The shortened useful lives of these coal-fired units result in increased depreciation expense, a portion of which the Company is proposing to defer as a regulatory asset to partially mitigate impacts to customers as described in more detail in Section VII below.

Cost recovery for Vogtle is handled in a separate docket.

Southern California Edison Co. (CA)

In its explanation for a rate increase, Southern California Edison (SCE) Co. made it clear that state-driven greenhouse gas reduction mandates were the driving force behind the rate case:

The bulk of SCE’s revenue requirement request in this GRC relates to the foundational work that SCE has always performed to maintain and improve the grid and the support functions necessary to provide our services, while continuing the investments necessary to implement the State’s primary policy objective to reduce greenhouse gas (GHG) emissions [emphasis added]. SCE is dedicated to performing these crucial functions in a manner that is affordable for customers and is fundamentally committed to spending customer dollars wisely and prudently to provide commensurate value for the important services that we provide. As the Legislature recently recognized, SCE needs to continue to do the important work and make the investments that are crucial to fostering the health of the California economy. SCE’s requests in this GRC are vital to that goal.

California has prioritized greenhouse gas reductions over the reliability and affordability of its electric grid. The results have been rolling blackouts and skyrocketing prices. The beatings will continue until policy improves.

Arizona Public Service Co. (AZ)

The Arizona Public Service (APS) company also justifies its rate case with the need to continue investments in new generation sources to aid the “energy transition.”

In this Application, Arizona Public Service Company (APS or Company) seeks a net increase in base rates of $460 million, or 13.6%, to become effective on December 1, 2023. The requested increase is necessary for APS to continue making the investments required to maintain a reliable, resilient, and clean energy grid for its customers today and into the future.

APS explained the company’s situation in more detail:

APS’s last rate case concluded on November 9, 2021, and was based on a test year that ended on June 30, 2019. A variety of factors have changed since the conclusion of APS’s last rate case, including significant investment in plant and infrastructure, revenue and expenses, the cost of capital, customer growth, compounded inflationary pressures, and disruptions to the global supply chain.

Among the items listed for the investments made by the company include infrastructure for EV-charging stations and three new renewable projects.

Duke Energy Progress (NC)

Duke Energy Progress is perhaps the most honest in its explanation of what’s driving the company’s rate increase request:

Centered on the Company’s obligation to provide reliable and dependable service, as well as to respond to the evolving energy and climate priorities of North Carolina and our customers, the Company has made significant investments, and will continue to make significant investments that will, in part, allow us to deliver increasingly clean energy. Recent and future investments needed to transition to a cleaner energy future, achieve operational excellence, and enhance the customer experience have made it necessary for DEP to request an increase in its traditional base rate retail revenues of approximately $227.6 million, which represents an overall increase in its retail revenues of approximately 5.9%.

DTE Electric Co. (MI)

DTE Electric wasn’t as forthcoming as Duke Energy Progress:

The Company has determined the need for additional annual revenues in the amount of approximately $388 million effective as early as November 10, 2022, in order to recover, among other things, Applicant’s increased investments in plant involving generation and the electric distribution system and the associated depreciation and property tax increases. The increased investments and related expenses are offset by lower operation and maintenance (“O&M”) expenses.

Let’s focus on those investments involving generation and electric distribution systems. A little further down, DTE Electric clarifies when asked what the rate increase request will support:

The generation fleet is expanding to cleaner resources with the expected start-up of the Company’s new natural gas plant, A. F. CROZIER Line U-20836 No. AFC-7 Blue Water Energy Center (BWEC), in the second quarter of 2022 and continuing the retirement of our Tier 2 coal fleet. DTE Electric has retired four of its coal-fired facilities (Marysville, Harbor Beach, Conners Creek and River Rouge) and plans to retire two of its four remaining coal plants – St. Clair and Trenton Channel – in 2022.

Most of these shuttered coal plants owned by DTE were retired prematurely, robbing Michigan families and businesses of decades of inexpensive, reliable electricity.

Unfortunately, because DTE rushed into an energy transition that doesn’t have the solutions needed to provide inexpensive and reliable service, its customers were faced with one of the largest price increases of 2023. The recently-passed 100 percent carbon-free electricity mandates in Michigan will only ensure that the price of electricity continues to rise in the future.

Puget Sound Energy (WA)

Puget Sound Energy was also up-front on the reasoning for its rate increase request:

As discussed in more detail later in my testimony, to comply with the Clean Energy Transformation Act (“CETA”), over the next ten years PSE will need to acquire 3,838 megawatts (“MW”) of supply-side generation capacity additions, which is 115 percent of the capacity of PSE’s current owned generating assets, and 7,634,092 megawatt hours (“MWh”) of incremental energy from renewable and non-emitting resources, which represents more than one-third of PSE’s projected retail electric sales in 2030 (net of conservation and before demand-side resources).

PSE explicitly listed the CETA as the main driver of increasing rates, and even noted that the company would need to build more than double its existing system in order to comply with the mandate.

Conclusion: The energy transition is expensive

Despite the fact that wind and solar advocacy groups constantly misrepresent levelized cost of energy (LCOE) values to claim wind and solar are the cheapest forms of electricity generation, there is no way around this point: the energy transition comes with a hefty price tag that will only increase as climate goals become stricter.

The rate cases examined clearly label so-called “energy transition” investments as major drivers of rising electricity costs, and as long as we continue to play stupid games with our electric grid, we will continue to win stupid prizes.

Long comment, as a former PG&E customer, the rate increases are more nuanced than the hard numbers show. California has a tiered rate system for IOUs, as you use more energy the rate you pay goes up. They also have time of use, so each of the three rate periods had its own set of teirs. So super peak tier 3 you're paying over fifty cents kwh. They massage the energy allowance in each teir every year. You would have to look into other states rate structures to see if there are similar games being played elsewhere.

Another thing to note is PG&E, SCE,& DTE along with having high rates also have among the highest customer outage minutes per year. Not only expensive, but unreliable too. If you want to watch where the Power outages are, go to poweroutage.us.

Ohio is doing things different, they have an open market for energy called Energy Choice Ohio. The utilities get paid for delivery and have a standard offer rate you can take or shop. I do shop, and I can tell you the utility delivery charges are always the larger part of the bill.

Worth noting that natural gas prices are much cheaper than they were 15 years ago, so electricity prices could have gone down.